The XRP Tracker Fund just launched in Asia, and it might be a bigger deal than most people realize. HashKey Capital, one of Hong Kong’s leading crypto firms, rolled out the region’s first XRP (XRP-USD) investment product backed by Ripple itself — and yes, the fund is already eyeing a full ETF conversion.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

HashKey Launches Asia’s First XRP Tracker Fund

Let’s start with the facts. HashKey Capital announced the launch of the XRP Tracker Fund on April 18. The fund is aimed at professional investors in Asia. The fund lets institutions gain exposure to XRP without managing wallets, keys, or direct token purchases. It offers both cash and in-kind subscriptions, along with monthly liquidity.

Ripple, the company behind XRP, didn’t just endorse it — they backed it financially as the fund’s anchor investor. Fiona Murray, Ripple’s managing director for Asia-Pacific, called it a move to bring “more regulated crypto products” to institutional investors in the region.

Vivien Wong, a partner at HashKey, said the fund is “only the beginning,” with plans already underway to tokenize money market funds and explore new DeFi investment tools using the XRP Ledger.

XRP ETF Would Unlock Massive Capital Inflows

Now here’s where it gets interesting. The Tracker Fund isn’t technically an ETF yet — but it’s built like one. And according to HashKey Capital, converting it into a proper XRP ETF is firmly on the roadmap.

If that happens, it could be a turning point for XRP’s price action.

According to Hank Huang, CEO of Kronos Research, this fund “marks a pivotal moment for institutional adoption.” He told Cointelegraph that regulated, transparent products like these are “what institutional investors need to enter the market.”

More importantly, ETFs historically drive inflows. Bitcoin ETFs in the U.S. and Hong Kong saw multi-billion-dollar volume within weeks. If XRP gets a similar structure, it could bring fresh capital from pensions, asset managers, and regional hedge funds — the kind of inflows that move markets.

And if those investors are buying XRP on monthly cycles, that steady demand could start to put serious pressure on supply.

Ripple and HashKey Plan More XRP-Based Products

This isn’t a one-off. Ripple and HashKey say they plan to keep building regulated products on the XRP Ledger. Wong says they’re exploring “cross-border DeFi” solutions and the tokenization of traditional assets.

Asia might have just lit the match for the first real XRP ETF. And if it catches fire, it could send XRP’s price and adoption to a very different level.

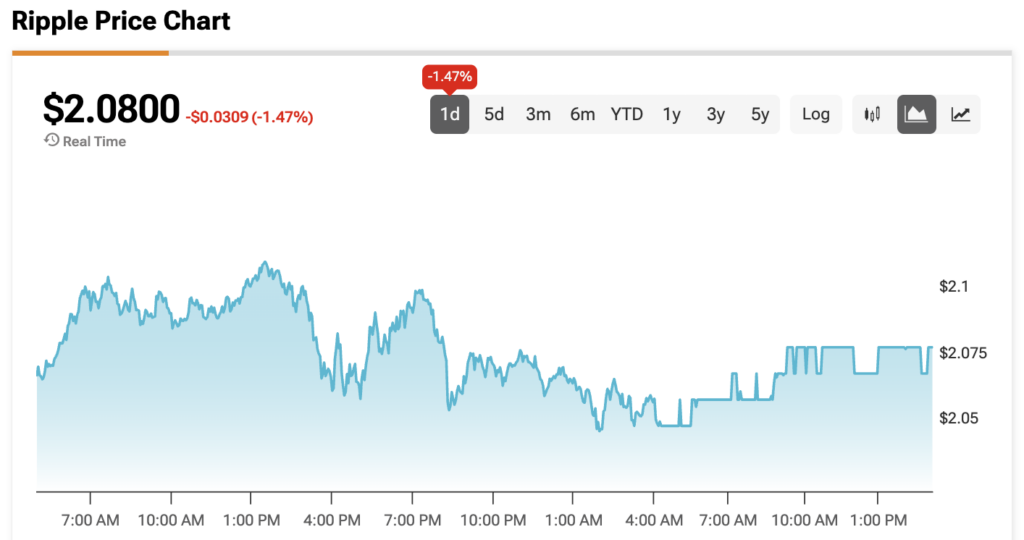

At the time of writing, XRP is sitting at $2.08.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue