Shares of cryptocurrency exchange Coinbase (NASDAQ:COIN) surged in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at $1.04, which beat analysts’ consensus estimate of $0.02 per share.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Sales increased by 51.6% year-over-year, with total revenue hitting $953.8 million and Subscription and Services revenue coming in at $375 million. Total revenue beat analysts’ expectations by $135 million.

Looking forward, management now expects Subscription and Service revenue for Q1 2024 to be in the range of $410 million to $480 million.

Is COIN a Good Buy Now?

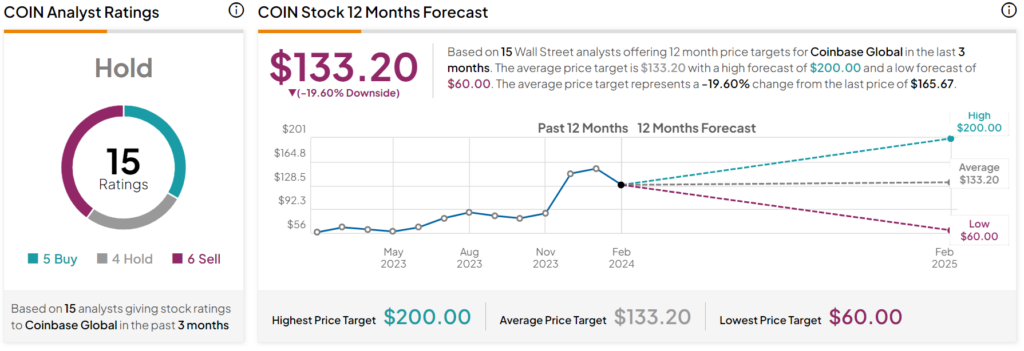

Turning to Wall Street, analysts have a Hold consensus rating on COIN stock based on five Buys, four Holds, and six Sells assigned in the past three months, as indicated by the graphic below. After a 152% rally in its share price over the past year, the average COIN price target of $133.20 per share implies 19.6% downside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue