Shares in IT group Cognizant (CTSH) climbed higher today as it cheered investors with a share buyback bonanza and a deepening AI partnership with Nvidia (NVDA).

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Share Purchase Ramp Up

Cognizant was 3% higher in early trading as its board gave the green light to a $2 billion ramp-up in its current share repurchase plan. That takes the total amount of the program to a hefty $3.1 billion. Cognizant said it expects to buy back shares worth $1.1 billion this year, which is up by $500 million over previous expectations.

Cognizant, which was hosting its investor day today, also revealed plans to accelerate the adoption of AI technology in industry built on Nvidia AI. This includes enterprise AI agents, industry-specific large language models, digital twins for smart manufacturing, and providing clients access to Nvidia AI technology via “GPU as a Service.”

Activist Pressure

It comes at a good time for Cognizant, which, as reported by Reuters, has faced volatile IT services demand as a result of economic uncertainty and high interest rates pressuring client budgets. Indeed, only last month Cognizant forecasted that its annual revenue would come in below analysts’ estimates.

It has also been facing activist investor pressure in the shape of Mantle Ridge, which has reportedly built a stake worth more than $1 billion in Cognizant and has been discussing with it ways to boost the share price. It is up around only 4% year to date.

Is CTSH a Good Stock to Buy Now?

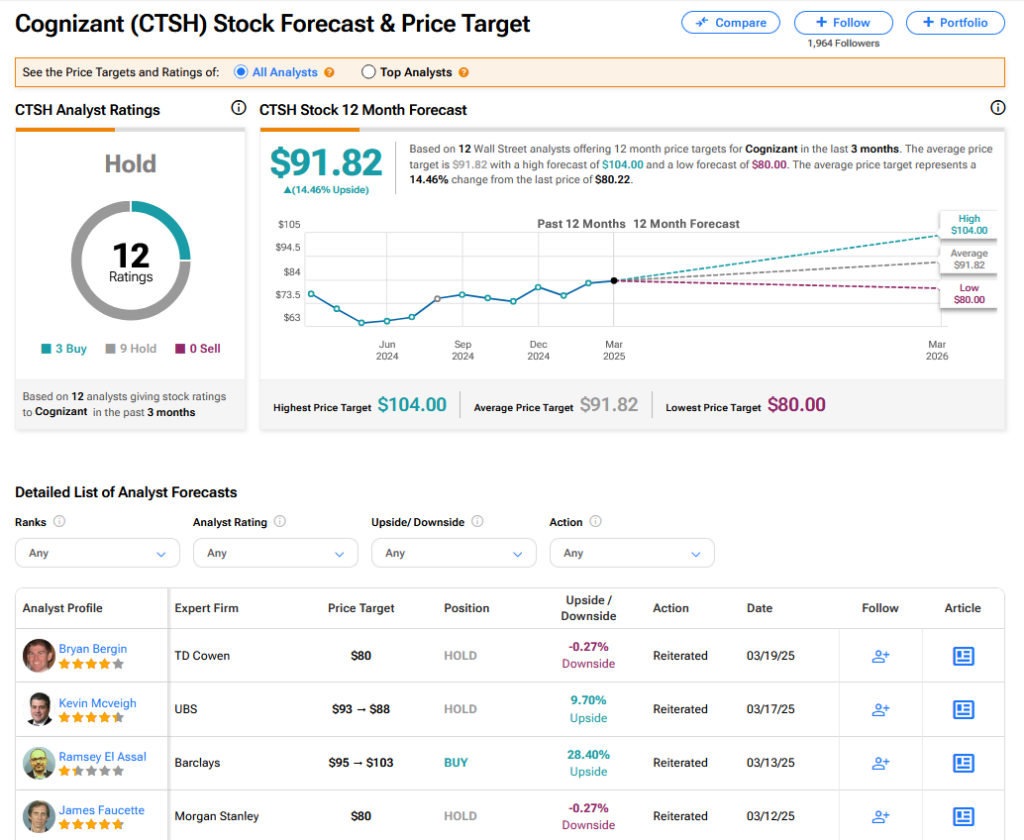

On TipRanks, CTSH has a Hold consensus based on 3 Buy and 9 Hold ratings. Its highest price target is $104. CTSH stock’s consensus price target is $91.82 implying an 14.46% upside.