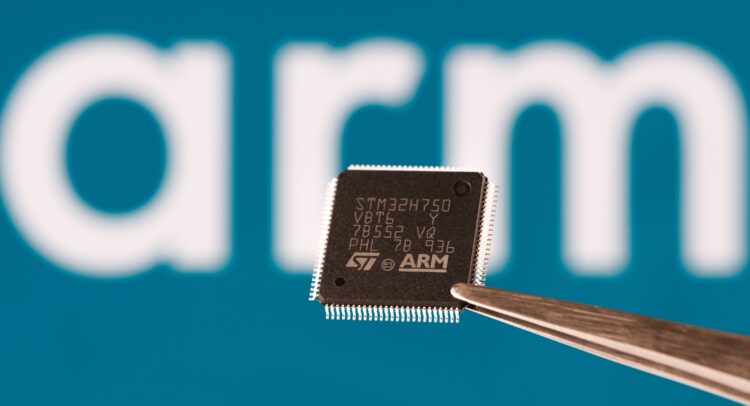

Microchip designer Arm Holdings (ARM) is taking valuable market share from key rivals such as Advanced Micro Devices (AMD) and and Intel (INTC), say analysts at Citigroup (C).

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

According to a new research report from Citi, Arm’s share of processor unit shipments grew to 13.6% in the first quarter of this year from 10.8% in the fourth and final quarter of 2024. Those market share gains came at the expense of both Intel and AMD, says the Wall Street bank.

Intel’s share of the market declined to 65.3% in Q1 of this year, its lowest level since Citi began collecting the industry data back in 2002. AMD’s share decreased quarter-over-quarter to 21.1% from 22.1%, said Citi in its report.

Buy Rating

Citigroup cut its price target on ARM stock to $170 from $200 after the company’s recent financial results but maintained a Buy rating on the shares. Citi maintains Hold-equivalent neutral ratings on both AMD and INTC stocks.

The stocks of chipmakers have had a turbulent start to the year but appear to be on the rebound after the U.S. and China agreed to lower most of their import tariffs and continue negotiating a trade deal. The stock of Arm Holdings has risen 7% this year.

Is ARM Stock a Buy?

The stock of Arm Holdings has a consensus Moderate Buy rating among 19 Wall Street analysts. That rating is based on 15 Buy, three Hold, and one Sell recommendations issued in the past three months. The average ARM price target of $146.80 implies 10.33% upside from current levels.