Pet supplies retailer Chewy (CHWY) is scheduled to announce its results for the first quarter of 2025 tomorrow, June 11. Chewy stock has rallied over 100% in the past year and is up 38% year-to-date, fueled by a rebound in active customer growth, strong Autoship sales (a subscription-style program for recurring pet supply deliveries), and better-than-expected Q4 earnings. Several analysts remain optimistic ahead of the Q1 print, calling it a potential catalyst.

Confident Investing Starts Here:

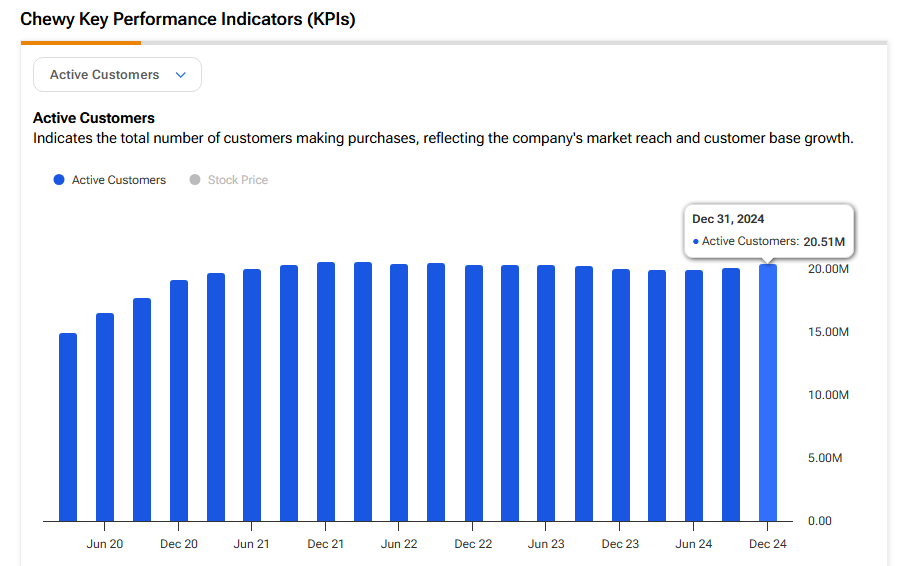

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Wall Street analysts expect the company to report earnings of $0.17 per share, reflecting more than 13% year-over-year growth. Meanwhile, revenues are expected to grow by 7% from the year-ago quarter to $3.08 billion, according to data from the TipRanks Forecast page. It’s important to note that Chewy has outperformed EPS estimates in seven of the past nine quarters.

Analyst’s Views Ahead of CHWY’s Q1 Print

Ahead of the Q1 report, Mizuho Securities analyst David Bellinger downgraded Chewy to Hold but raised the price target to $47 from $43. He acknowledged that customer and revenue growth have improved in recent quarters but believes these positives are already priced in, especially after the stock’s sharp 55% rally from April lows. “We wouldn’t be putting new money to work at these levels,” Bellinger wrote, pointing to the stock’s forward EV/EBITDA multiple of over 22x, which he considers stretched.

Despite the downgrade, Mizuho still expects Chewy to beat estimates in Q1. The firm projects 8–9% revenue growth, ahead of Chewy’s own guidance of 6–7%. That said, Bellinger believes the market will pay close attention to management’s commentary on Q2 trends and the full-year outlook. For the rally to continue, he believes Chewy needs to report strong active customer growth, improving margins, and a clear pickup in revenues.

According to Main Street Data, Chewy’s active customer base rose by about 2% year-over-year to 20.5 million in Q4 2024, marking its first year-over-year growth in eight quarters.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 9.31% move in either direction.

Is Chewy a Good Stock to Buy?

Overall, Wall Street has a Moderate Buy consensus rating on Chewy stock based on 17 Buys and seven Hold recommendations. Given the solid year-to-date rally, the average CHWY stock price target of $43.45 implies about 6.58% downside risk for current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue