The stock of oil major Chevron (CVX) has been upgraded to a Buy rating by analysts at Citigroup (C).

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Alastair Syme, a four-star rated analyst on TipRanks, lifted his target price on CVX stock to $185 from $145 previously and gave the shares a Buy rating. Syme said that Chevron’s stock has been held back this year over concerns that its $53 billion acquisition of rival oil producer Hess (HES) may not succeed.

Syme said worries about the Hess deal are overblown and added that Chevron’s crude oil exploration in Namibia could be a big catalyst for CVX stock if a new discovery is made. Chevron, which is the second-biggest U.S. oil company, has seen its stock rise rise about 14% this year.

New Forecast for Crude Oil

The bullish forecast for CVX stock comes on the same day that Bank of America (BAC) issued a downbeat outlook for crude oil prices in 2025. Bank of America Securities is forecasting that prices for Brent crude oil, the international standard, will average $65 a barrel, and West Texas Intermediate (WTI) crude oil, the U.S. benchmark, will average $61 per barrel next year.

Oil prices have slumped nearly 10% over the past three months on concerns that global demand is weakening. Bank of America expects demand to remain weak over the coming year, especially in China. WTI crude oil is currently trading at $69.36 per barrel. The price of Brent crude oil is at $73.40 a barrel.

Is CVX Stock a Buy?

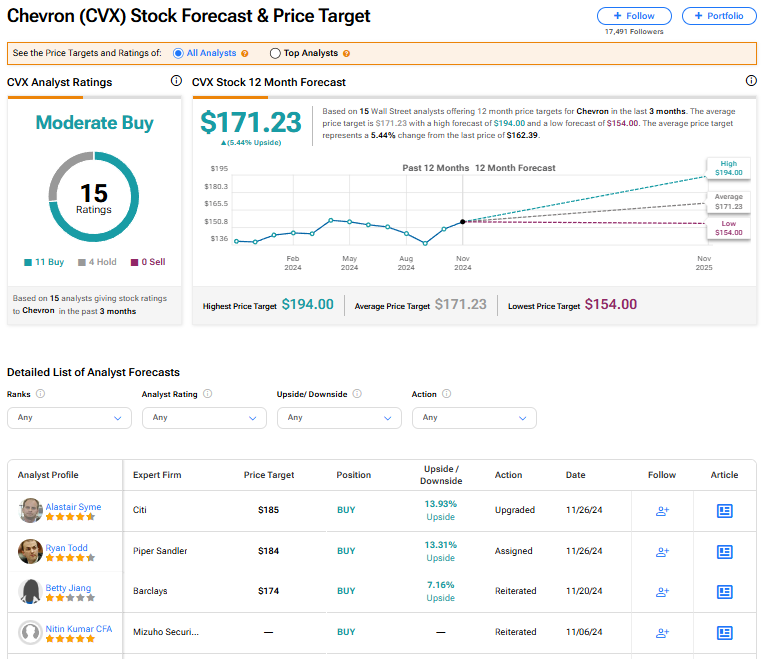

Chevron’s stock has a consensus Moderate Buy rating among 15 Wall Street analysts. That ratings is based on 11 Buy and four Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average CVX price target of $171.23 implies 5.44% upside from current levels.

Read more analyst ratings on CVX stock

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue