Celcuity (CELC) is making strides with its lead therapeutic candidate, Gedatolisib, currently in Phase 3 clinical trials. It shows promising potential as a first-line treatment for HR+/HER2- advanced breast cancer, and early clinical data suggest it has the potential to be a game-changer in targeted cancer therapies. The company recently strengthened its balance sheet through equity and debt offerings totaling $129 million to expedite the initiation of the Phase III study.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The stock is up 61% year-to-date and has substantial potential upside. It is a compelling opportunity for investors interested in emerging biotech stocks with near-term catalysts.

Celcuity Accelerates Phase 3 Trial

Celcuity is a clinical-stage biotechnology company advancing the development of targeted therapies for various types of cancer.

The company’s primary drug under evaluation, Gedatolisib, is undergoing a Phase 3 clinical trial, VIKTORIA-1, for HR+/HER2- advanced breast cancer and a Phase I/II trial to assess its potential against metastatic castration-resistant prostate cancer. Additionally, the company has started another Phase 3 study, VIKTORIA-2, to investigate Gedatolisib as a potential first-line treatment option.

Assuming regulatory approvals are close, nearly 200,000 late-stage cancer patients worldwide could be treated with Gedatolisib, giving it blockbuster potential.

In anticipation of entering a Phase 3 study, the company took steps to bolster its balance sheet, raising $129 million from equity and debt offerings. Also, CELC’s management has indicated that this move allowed the company to initiate the trial 12 months earlier and could add over $1 billion to the potential revenue value from this treatment.

Analysis of Celcuity’s Recent Financial Results

The company recently announced its financial results for Q2 2024, but no revenue was reported for the quarter. Research & Development expenses surged to $22.5 million compared to the past year’s $13.8 million. This was primarily due to the VIKTORIA-1 Phase 3 trial and the initiation of the CELC-G-201 Phase 1b/2 clinical trial, which accounted for $6.6 million. General & Administrative expenses also rose to $1.8 million from the previous $1.3 million. The non-GAAP adjusted net loss was $22.2 million, translating to a loss of $0.62 per share, surpassing analysts’ predictions of -$0.68.

The company’s cash burn rate increased as net cash in operating activities grew from $9.7 million in Q2 2023 to $18.1 million. As of the quarter’s end, Celcuity has reported cash, cash equivalents, and short-term investments amounting to $283.1 million.

What Is the Price Target for CELC Stock?

The stock has bounced around recently while posting a 3% gain year-to-date. It trades near the middle of its 52-week price range of $8.39 – $22.19 and shows negative price momentum by trading below its 20-day (16.33) and 50-day (16.63) moving averages.

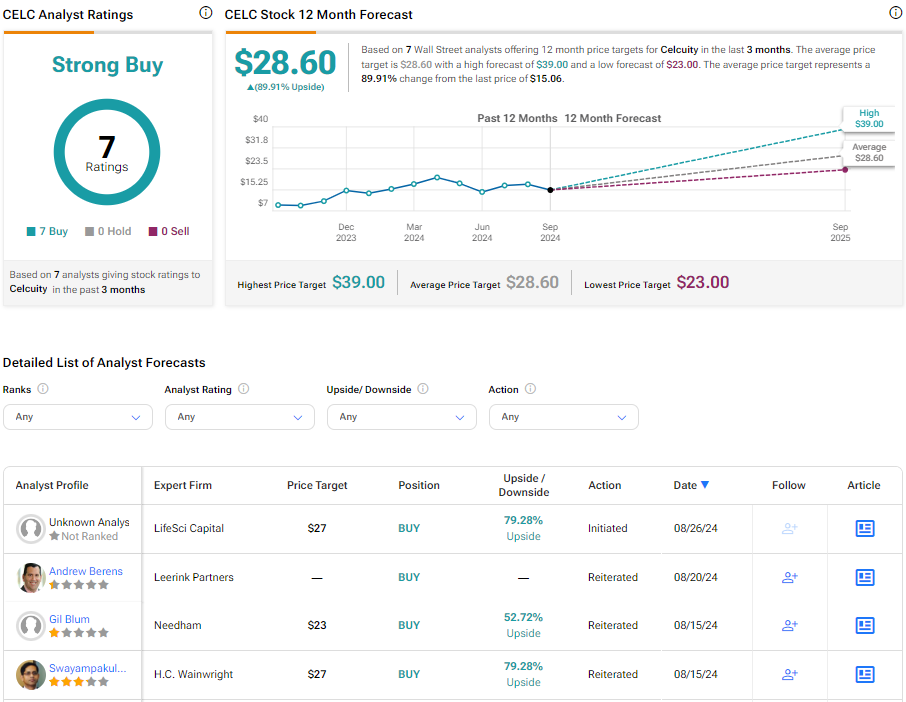

Analysts covering the company have been bullish on CELC stock. For instance, Leerink analyst Andrew Berens recently initiated coverage on the stock with an Outperform rating and a $29 price target, noting early data suggest Gedatolisib has the potential to be a best-in-class inhibitor in patients.

Celcuity is rated a Strong Buy based on seven analysts’ recent recommendations and price targets. The average price target for CELC stock is $28.60, representing a potential upside of 87.79% from current levels.

Closing Thoughts on CELC

Celcuity’s lead treatment candidate is showcasing promising potential as a first-line treatment for HR+/HER2- advanced breast cancer. The company successfully raised $129 million to expedite the initiation of the Phase III study, accelerating potential catalysts for the stock. CELC is an attractive opportunity for investors interested in emergent biotech stocks with imminent triggers and significant upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue