The news from Omaha last week, that Warren Buffett would be stepping down from his role as CEO of Berkshire Hathaway (NYSE:BRK.B) at the end of the year, ricocheted throughout the investment world.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Though the news was hardly a major shocker – Buffett is turning 95 this year – it still has major implications for the company he helms. The “Oracle of Omaha” has built an investment empire, doling out wisdom and folksy charm along the way, that has delivered unparalleled consistency and success throughout the decades.

Berkshire Hathaway has thus far ably navigated the stormy waters of 2025, and its share price is up some 13% year-to-date. However, Buffett’s announcement last Saturday has shaken investors, as BRK.B dropped over 5% in the first day of trading following the news that Greg Abel would be succeeding him.

In contrast, one top investor known by the pseudonym The Value Portfolio isn’t too worried about the transitioning leadership.

“The process of selecting a successor and introducing them to the business appears to have been nearly flawless,” asserts the 5-star investor, who sits in the top 2% of TipRanks’ stock pros.

For starters, this development has been in the works for some time. Indeed, Value Portfolio notes that Buffett had previously announced a few years back that Abel (who has been running Berkshire Hathaway Energy since 2009) would be taking the reins from him upon his eventual departure.

Going forward, Berkshire Hathaway has a massive amount of cash on hand – $347 billion at the end of last quarter – points out Value Portfolio, which gives the company plenty of room for investments. The investor expects Berkshire Hathaway to focus on infrastructure acquisitions.

“Berkshire Hathaway has an unparalleled portfolio of assets,” explains Value Portfolio, adding that the company “remains well-positioned for robust shareholder returns.”

Though not without risk, Value Portfolio has faith that Abel will succeed in following Buffett’s vaunted footsteps.

“Greg Abel (is) poised to lead Berkshire Hathaway, ensuring a smooth succession and continued strong earnings,” affirms The Value Portfolio, who rates BRK.B a Strong Buy. (To watch The Value Porfolio’s track record, click here)

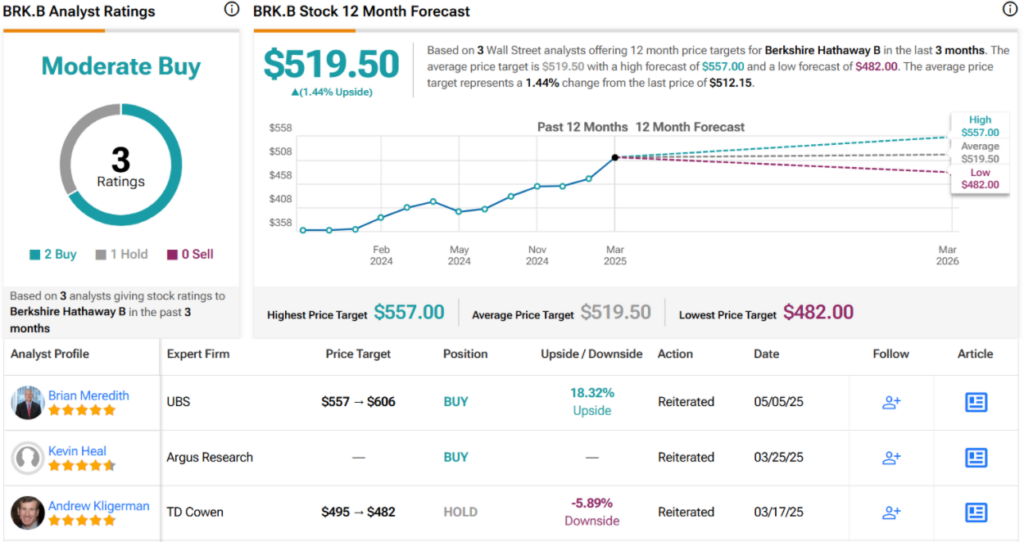

Only one analyst has re-evaluated Berkshire Hathaway since the news broke, Brian Meredith from UBS, who re-iterated a Buy rating. Meredith is joined by one other Buy and one Hold, giving BRK.B a Moderate Buy consensus rating. Its 12-month average price target of $519.50 implies minimal movement in the year ahead. (See BRK.B stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.