Amazon (NASDAQ:AMZN) has made several high-profile acquisitions in recent years, including the $13.7 billion purchase of Whole Foods in 2017 and the $8.45 billion acquisition of MGM Studios in 2022.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

But long before these deals, Amazon made a strategic bet that would quietly redefine its core operations. In 2012, it acquired Kiva Systems for $775 million – a move that laid the foundation for the company’s massive push into automation. That early investment has since evolved into a robotics powerhouse, with Amazon now deploying more than 20 types of robots and operating a fleet of over 750,000 units.

Although robots are already deeply integrated into Amazon’s fulfillment centers, Bank of America’s Justin Post, an analyst ranked in the top 1% of Wall Street stock experts, thinks the company is still in the early stages of broader robotics adoption, as evidenced by the late-2024 launch of its automated fulfillment center and the May announcement of eight new robots for delivery stations set to be deployed over the next two years.

“Robots will be instrumental in improving Amazon’s long-term cost structure,” says Post, “likely by: 1) reducing labor dependencies and impact of wage inflation; 2) reducing employee injury costs; 3) increasing order accuracy, and 4) driving higher warehouse utilization.”

Post thinks Robotics could strengthen Amazon’s “competitive moats,” especially as increased transparency in an AI-driven retail landscape favors companies with lower costs and faster delivery. According to Amazon, recent AI advancements have brought a “step change” in how automation can help its employees, opening the door for further logistical innovation. The development of spatially aware robots capable of sorting, picking, and packing represents a “significant breakthrough” in fulfillment and delivery – one that Amazon is likely to embrace well ahead of rivals, thanks in part to its leadership in AI through AWS.

The cost-saving potential of robots is not to be sniffed at. The new 12th-generation fulfillment centers – equipped with 10 times more robots – are expected to reduce peak period service costs by 25%. The multi-year rollout of these advanced centers and retrofitting of existing facilities is underway, after kicking off with the initial one last year. Amazon is also deploying more robots in delivery stations and piloting autonomous drone deliveries in Texas and Arizona. Based on estimated efficiency gains – 20% in new fulfillment centers, 15% in updated delivery stations, and 40% for drone deliveries on select packages – by 2032, Post reckons robotics could generate up to $16 billion in annual cost savings.

Additionally, there’s still a way to go in improving margins. The 2024 retail operating profit margin of 5.4% amounts to a big improvement vs. 2022, and Post thinks that over the long-term, there is potential for margins to reach 11%, based on assumptions of a 55% margin on advertising, 20% on third-party (3P) services, 5% on subscriptions, breakeven for 1P (first-party) retail, and $10 billion in annual investment spending.

“We think robots and drones will increase Amazon’s shipping speed advantages, and could add another 2pts to Amazon’s long-term retail margins, helping move 1P toward better profitability in a very price-transparent AI world,” Post further said.

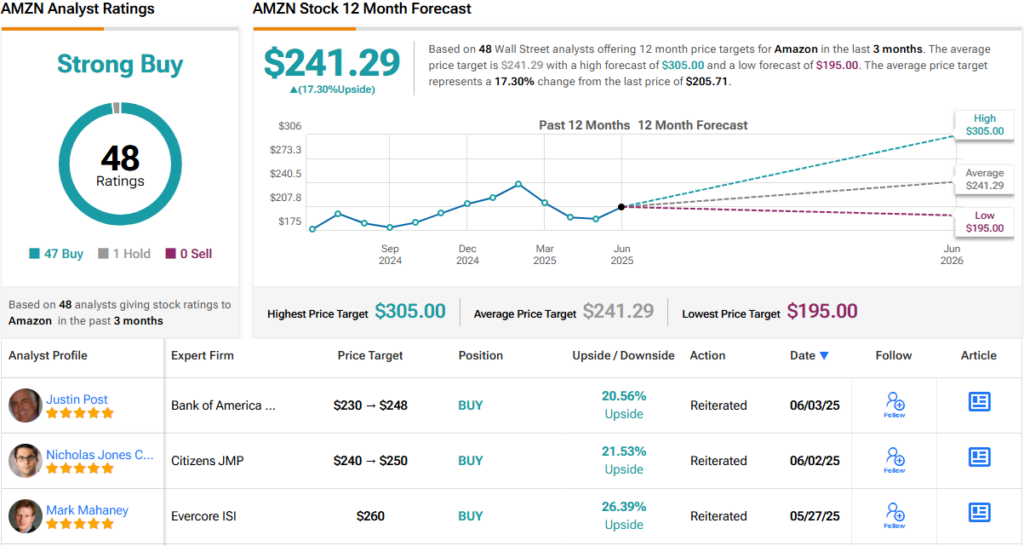

Conveying his confidence, Post assigns a Buy rating to AMZN shares and raises his price target from $230 to $248, suggesting the stock could gain ~21% in the months ahead. (To watch Post’s track record, click here)

That is just one of many bullish AMZN takes on Wall Street; the stock’s Strong Buy consensus rating is based on a lopsided mix of 47 Buys and 1 Hold. Going by the $240.62 average price target, a year from now, the shares will be changing hands for a 17% premium. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.