In this piece, I evaluated two chipmaker stocks, Broadcom (AVGO) and Arm Holdings (ARM), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a bullish view of Broadcom and a bearish view of ARM stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While both companies make semiconductors for various applications, U.S.-based Broadcom focuses on data centers, artificial intelligence, wireless and broadband, networking, software, and industrial markets. Meanwhile, U.K.-based Arm Holdings focuses on central processing units (CPUs), graphics processing units (GPUs), neural processing units (NPUs), and interconnect technologies.

Broadcom just went through a 10-for-one stock split, so on some sources, it may have initially looked like the stock price suddenly plunged, but that wasn’t the case. The price is now roughly 10% of where it was trading at the closing bell last Friday.

Broadcom stock has actually soared year-to-date, rising from about $1,077 on January 1 to $1,700 on Friday before the stock split. On a split-adjusted basis, the shares are up 44% year-to-date and 82% over the last year. Meanwhile, Arm Holdings stock is up 116% year-to-date and 167% over the last year.

In general, chipmaker stocks have been soaring this year as evidenced by both companies’ year-to-date returns. However, a closer look is needed to see whether Arm’s much-larger return is warranted. We’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry.

For comparison, the semiconductor industry is trading at a P/E of 61x versus the three-year average of 35.5x.

Broadcom (NASDAQ:AVGO)

At a P/E of around 68x, Broadcom is trading at a relatively small premium to the broader industry (for reference, Nvidia’s (NVDA) trailing 12-month P/E is around 70x, almost in line with Broadcom’s). However, AVGO’s forward P/E of 29.3x is even more attractive. Thus, a long-term bullish view may be appropriate — with the caveat that more volatility could be around the corner.

This week brought significant volatility, as the stock plunged on Wednesday before stabilizing somewhat today following a report that Broadcom was in talks with OpenAI to develop an AI chip. However, based on historical data, the stock could rise as much as 25% over the next 12 months, which is a key reason to take a long-term view. Essentially, Bank of America (BAC) stated, “Historically, stocks have notched 25% total returns in the 12 months after a split is announced, compared to 12% for the broad index.”

A 10-for-one stock split gives investors nine additional shares for each share they own. In short, every one share becomes 10 shares, and the company’s stock price automatically falls to one-tenth of the previous price.

However, the company’s overall valuation does not change; only the number of shares has changed, so the per-share price adjusts accordingly. Companies perform splits like these to make their shares more accessible to individual investors by slashing the per-share price.

The recent sell-off in Broadcom shares has made them more attractive over the past week. Additionally, Broadcom’s valuation is quite compelling at current levels compared to other chipmaker stocks, especially with the prospect of sizable 12-month and long-term gains.

While Broadcom hasn’t enjoyed quite the same level of explosive growth as certain other semiconductor names (43% revenue growth in Q1), its exposure to the data center market should mean great things for its growth. Artificial intelligence requires more and more advanced servers, which should benefit Broadcom over the long term. The report about an AI chip being in the works is also bullish for the stock.

What Is the Price Target for AVGO Stock?

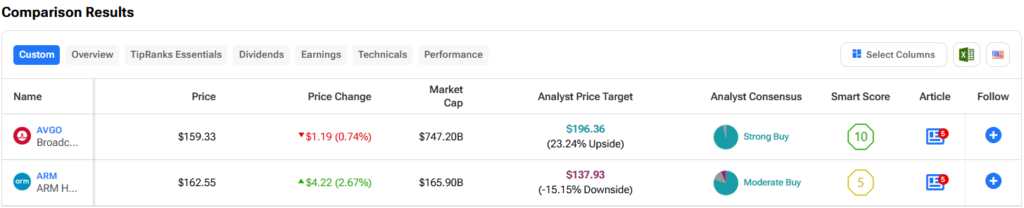

Broadcom has a Strong Buy consensus rating based on 23 Buys, one Hold, and zero Sell ratings assigned over the last three months. At $196.36, the average Broadcom stock price target implies upside potential of 23.2%.

Arm Holdings (NASDAQ:ARM)

At a P/E of around 546x, Arm Holdings immediately looks overvalued. Its forward P/E of 101.1x isn’t much better, suggesting a bearish view might be appropriate, especially considering its much smaller scale than Broadcom.

Arm designs and licenses its chip architecture to other companies, while Broadcom is a fabless chipmaker, meaning it designs chips and then outsources manufacturing. However, the company is much smaller than Broadcom, posting $928 million in revenue for the most recent quarter — dwarfed by Broadcom’s $12.5 billion.

Thus, it’s worth considering whether a company with less than $1 billion in quarterly revenue deserves a market capitalization on the order of $171 billion. It certainly seems that Arm’s valuation has gotten ahead of itself. While Arm Holdings is an excellent, growing company with 20.7% revenue growth in the last year, its current valuation simply isn’t warranted.

However, investors should also keep an eye on Arm’s net income, which fell from $524 million in the fiscal year that ended in March 2023 to $306 million in fiscal 2024. This could become another cause for concern, especially with such a high valuation.

What Is the Price Target for ARM Stock?

Arm Holdings has a Moderate Buy consensus rating based on 12 Buys, two Holds, and one Sell rating assigned over the last three months. At $137.93, the average Arm Holdings stock price target implies downside potential of 16%.

Conclusion: Bullish on AVGO, Bearish on ARM

Both Broadcom and Arm Holdings could make excellent additions to an investor’s long-term portfolio, especially Broadcom at its current valuation. On the other hand, it appears that Arm Holdings stock may have to come down significantly in value.

Essentially, Arm is priced like a growth stock, but it just isn’t putting up the massive growth to warrant such a valuation. Thus, Arm looks overvalued while Broadcom looks almost fairly valued, although the prospects of a 25% gain over the next 12 months and even more over the long term suggest this could be the time to buy shares.