AutoZone (AZO) stock looks ready to accelerate, even as higher interest rates and sticker shock slow the new-car market. With most consumers opting to fix rather than replace, the auto parts giant is sitting in the right lane at the right time.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Repairs Beat Replacements as Prices Climb

The average new vehicle in the U.S. now costs over $48,000—and that’s before potential tariff hikes. With wallets tight and inflation still a concern, drivers are keeping their old cars running longer. That’s music to AutoZone’s ears.

Shares of the Memphis-based retailer have held up better than most during the recent tech-led selloff, closing at $3,614.27. Though they dipped on fresh tariff threats tied to key materials like steel and aluminum, analysts say the business remains resilient.

AutoZone’s Earnings Look Stronger Under the Hood

AutoZone’s latest earnings miss spooked some investors, but digging deeper tells a better story. Same-store sales rose 2.9% on a constant-currency basis, and international growth flipped positive. While do-it-yourself sales slowed, commercial revenue jumped 7%—a segment analysts say has major long-term potential.

“The beauty of the commercial business is that when mechanics need a part, they need it now,” said Christopher Conway of Focus Partners Wealth. “That’s where AutoZone’s distribution model shines.”

AutoZone’s Margins Hold Firm & AZO Stocks Buybacks Boost EPS

AutoZone continues to repurchase shares aggressively—cutting its outstanding stock by half over the last decade. EPS is expected to climb 13% in Fiscal 2025, then rise another 10% the year after. Gross margins, consistently above 50%, remain among the highest in retail.

Tariffs Pose a Threat—But Not a Dealbreaker

Even with tariff uncertainty, analysts say AutoZone’s pricing power and product mix make it less vulnerable. Car parts aren’t luxury items—they’re needs. “Passing on a small increase in price is a lot easier when the alternative is not being able to drive,” said Parnassus PM Andrew Choi.

What’s interesting is that the average U.S. car is now over 12 years old—so breakdowns are only getting more common. And when engines cough, drivers head to AutoZone.

Is AutoZone a Buy?

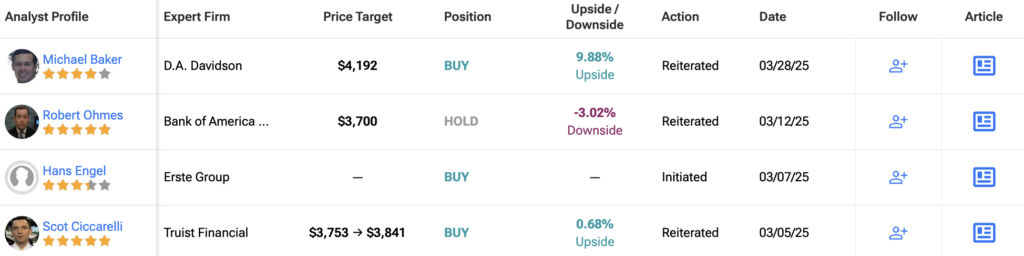

Analysts remain optimistic about AZO stock, with a Strong Buy consensus rating based on 20 Buys and two Holds. Over the past year, AZO has increased by 20%, and the average AZO price target of $3,832.95 implies an upside potential of 0.5% from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue