Meta Platforms (META) might still be best known as the social media giant behind Facebook, Instagram, and WhatsApp, but it’s quickly evolving into something far more significant. What’s flying under the radar for many is its transformation into a leader in AI and hardware. Despite the wide-ranging stock plunges in all sectors, I remain bullish on META.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Yes, the recent sell-off has rattled some investors—especially those unprepared for sudden macro shocks. META stock has swandived from around $700 in mid-February to ~$500 per share today. But there’s a lesson here. Build your portfolio with resilience in mind to survive and thrive through unexpected turmoil. If you’ve kept some cash on hand or have been dollar cost averaging all along, now is the time to lean in and start putting money to work in Meta. The AI train hasn’t derailed—it’s just pausing before accelerating again.

The AI Momentum Behind Meta

Meta’s ascent in artificial intelligence is nothing short of extraordinary. At the heart of this surge are two major initiatives. First, there’s LLaMA, the company’s open-source large language model. Then there’s Meta AI, the user-facing assistant already integrated into its core apps.

LLaMA was only released in 2023, yet by early 2025, it had surpassed one billion downloads. That kind of scale is staggering. By open-sourcing the models, Meta isn’t just participating in the AI race—it’s changing how the game is played. Instead of keeping its technology behind paywalls, Meta embeds AI within its vast social media ecosystem, accelerating internal development and third-party innovation.

AI is also quietly reshaping the user experience. More than half of the content consumed on Instagram has now surfaced via AI-driven recommendations. On Facebook, it’s about 30%. This translates into more intelligent ad targeting and, ultimately, more substantial revenue growth as marketers follow user engagement. But what’s even more interesting is the efficiencies Meta is gaining. By automating internal processes, the company is starting to chip away at its operating expenses. For a tech-heavy business like Meta, those savings can scale fast.

Despite short-term macro headwinds and global trade fears, the AI foundation Meta is building remains undervalued. The stock’s price-to-earnings ratio currently sits around 21—well below its historical average. That’s not a reflection of performance–it’s skepticism–and for forward-looking investors, it could be an opportunity. With the stock now trading below its 50-week moving average, those with a risk-on appetite may want to look closer.

LLaMA’s Role in Meta’s Future

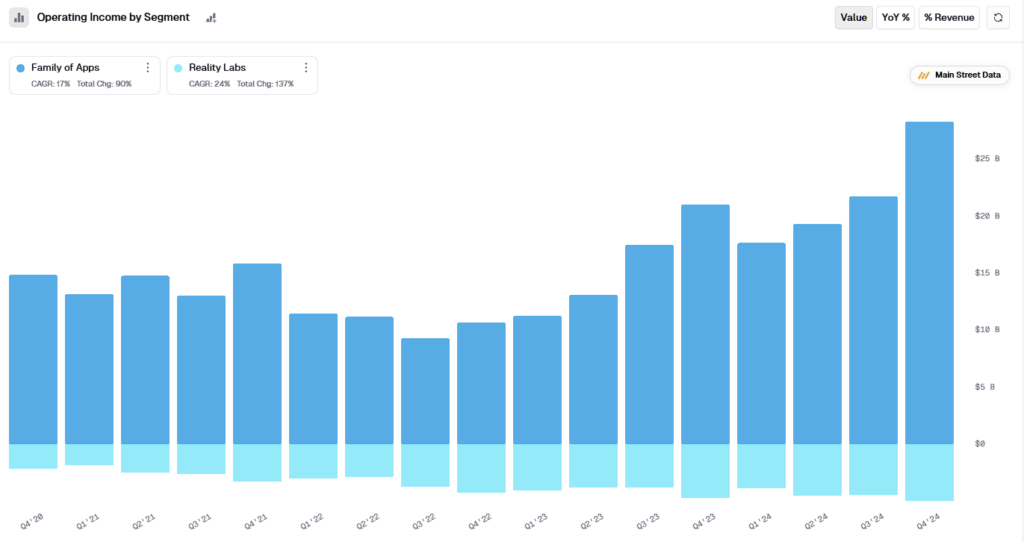

Meta’s ad platform is getting a significant boost from its AI capabilities. The Advantage+ campaign system, driven by machine learning, has more than doubled revenue. Meanwhile, the company’s Reality Labs division—though currently a drag on margins—is laying the groundwork for what could be a monumental hardware breakthrough. Between Ray-Ban smart glasses and the upcoming Orion AR headset, Meta is edging toward a potential iPhone moment of its own.

Still, it’s not without cost. Reality Labs posted a $17.7 billion operating loss in 2024. Yet Meta is forging ahead, budgeting between $60 billion and $65 billion for capital expenditures in 2025. That’s a hefty jump from the $39 billion it spent in 2024. The good news? META can afford it. The company generated over $52 billion in free cash flow last year and holds nearly $78 billion in cash on its balance sheet—against just $29 billion in debt.

What’s more, profitability is already on the rebound. Operating margins climbed back to roughly 42% in 2024, up from a low of 29% two years ago. Even so, the market hasn’t caught up. Meta continues to trade well below its decade-long average P/E of 32. That means the business’s full earnings power and AI-led potential simply aren’t priced in—yet.

Be Prepared for a Black Swan

When the market gets nervous, I stay calm. That’s because I run a black swan portfolio strategy designed to handle exactly these kinds of events. Going into the recent volatility, I had about 30% of my portfolio in cash. A diversified portfolio, including an appropriate cash allocation, allows me to absorb sudden shocks without resorting to panic.

The term “black swan” comes from Nassim Taleb, who described it as an unpredictable, high-impact event that people try to explain in hindsight. Think of the 2008 financial crisis, 9/11, COVID-19, or today’s spiraling trade war. You can’t see them coming. But you can prepare.

The easiest way to protect yourself is by holding cash or cash equivalents. During the recent market sell-off, I trimmed my cash position from 30% to 22.5%, reinvesting in undervalued names like Nvidia (NVDA). Meta is also now firmly on my radar as a company poised to lead a global economy increasingly driven by AI and robotics.

If we enter a deeper recession, I plan to reduce my cash holding to ~15%. If things get worse—say, a full-scale Taiwan crisis that crashes the S&P 500 (SPX) by 90%—I plan to deploy everything. The upside from buying into that kind of drop when the economy recovers could be remarkable.

Is Meta Platforms a Good Stock to Buy Now?

Wall Street is super bullish on META stock. Meta has earned a consensus Strong Buy rating, with 42 analysts recommending Buy and only three recommending Hold. Only one analyst is bearish on META. The average Meta Platforms price target is $748 per share, suggesting a 46.5% upside from current prices. Even amid geopolitical and economic uncertainty, that kind of bullishness speaks volumes.

Don’t Let Fear Drive You Out of AI

When markets become rough and volatile, the impulse to sell and retreat into cash is understandable—but usually misplaced. The smart money already had cash or hedges in place before the trouble started. The goal isn’t just to survive market shocks but to come out stronger–the epitome of resilience and anti-fragility. Meta is one of the best-positioned stocks in this new AI-driven world, and there may not be many better chances to establish a long META position at the discounts offered by a frightened market.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue