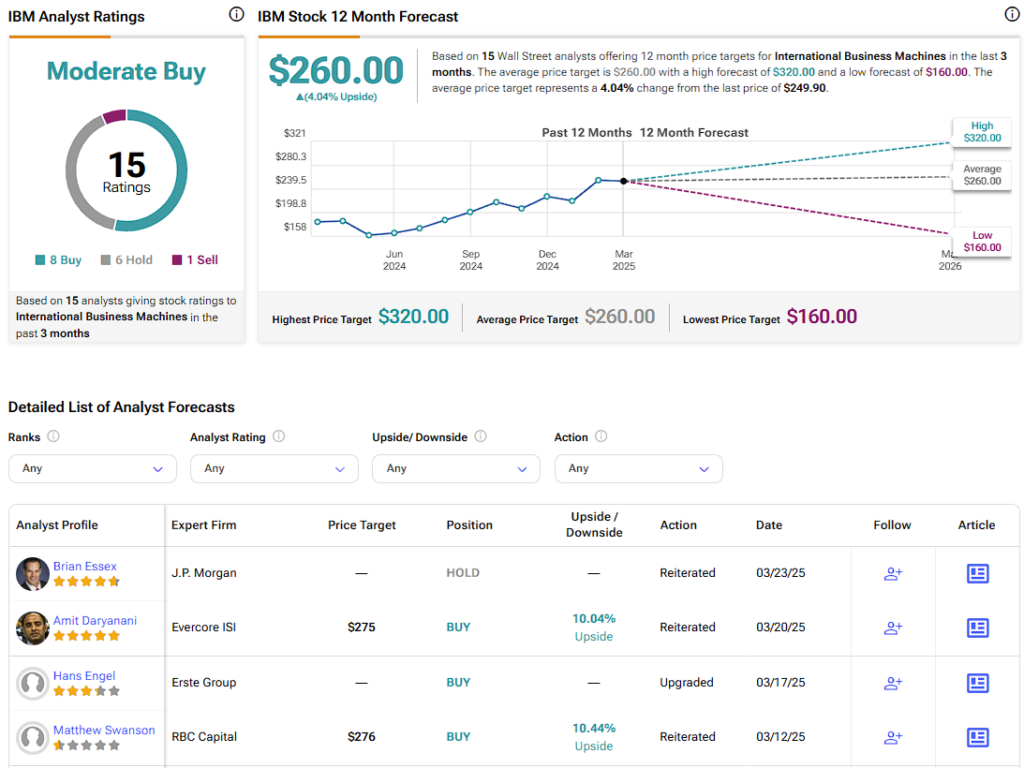

Despite the broader tech sector selloff, International Business Machines (IBM) stock now sits near its 52-week high. After peaking at $265 in 2025, it’s eased to ~$243, but it’s still up 30% over the past year. This surge has Wall Street excited about IBM’s turnaround, with its cloud and AI bets signaling a rosy future. But I’m skeptical. Dig deeper, and IBM’s fundamentals tell a weaker tale, as its financials and growth don’t match the hype. Top Wall Street analysts are currently split on the stock, although Swiss investment bank UBS analyst Daniel Vogt forecasts IBM trading at ~$160 by the end of the year.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Here are three reasons investors should consider ditching IBM stock right now, and why I’m stoutly bearish on this legacy IT powerhouse…

IBM Loses Attractive Dividend Play Status

IBM has long been a go-to for income-focused investors, boasting 25 consecutive years of dividend hikes, a feat that earned it dividend aristocrat status. Yet, that legacy is losing its luster. In recent years, IBM’s annual dividend “hikes” have become little more than symbolic gestures. Over the past four years, each hike has been by just a penny per share. This dividend growth slump has resulted in sluggish sub-1% annual raises that feel like they occur just for IBM to preserve its streak.

These tiny tweaks to the dividend haven’t kept up with inflation, much less the stock’s big price jumps, slashing the yield to a measly 2.8%, near a decade low. Compare that to the juicy 4–5% it used to churn out, and you see the problem. The stock’s climb has basically killed its charm for income seekers. IBM still wears the dividend aristocrat crown, but it’s a jaded version of the golden version it once was.

Weak Revenue Growth

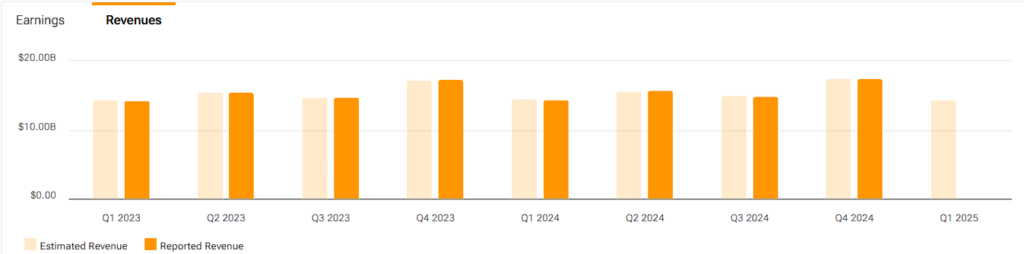

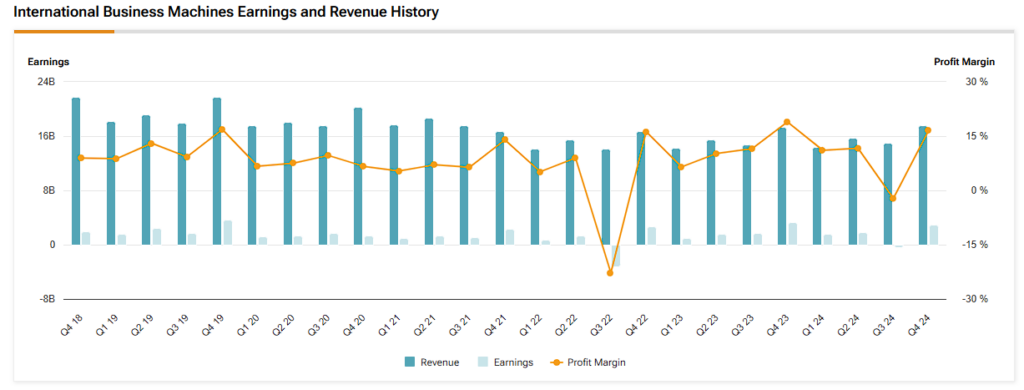

What I view as the biggest reason to sell IBM is its horrific revenue growth, which has been anemic for years, starkly contrasting with the booming tech sector. Last year, the company posted just 1.4% revenue growth, and its five-year annual sales growth averages a tepid 1.7%. This snail’s pace barely beats inflation, clearly reflecting a company struggling to find momentum. I think three key factors explain this stagnation.

To begin with, there is no doubt that IBM’s core business segments are faltering. Its mainframe hardware has hit a wall as the current product cycle matures, with sales dropping sharply in recent quarters. Likewise, once a reliable cash cow, its consulting division is stalling. Following softening demand, IBM’s latest report showed that consulting revenues were pretty flat (down 0.5%).

Another factor you must consider is IBM’s pivot to high-growth areas like cloud and AI, which has disappointed me somewhat. Its cloud market share languishes in the single digits, dwarfed by giants like AWS and Azure. Management has even admitted that any buzz around generative AI hasn’t translated into new sales for real; it’s more like merely reshuffling existing client budgets.

Finally, it has become clear that IBM lacks a bold, innovation-driven revenue driver. Many remember the past reinventions, like the transition to software in the ‘90s, propelled growth. Still, today’s IBM leans on incremental tweaks and acquisitions like Red Hat rather than game-changing breakthroughs. With a sales base of $60+ billion that refuses to budge, IBM feels stuck in neutral. And while management’s outlook of “mid-single-digit” growth seems easy to achieve, I would say it may still be ambitious given these headwinds.

Overvalued Stock with Poor Upside

This brings us to the third reason for going bearish on IBM stock: its rich valuation, especially against its underwhelming growth prospects. In fact, IBM’s stock price has run way ahead of its EPS growth, so, currently, the stock trades at a P/E of around 23× 2025 EPS of $10.72. Therefore, it’s fair to say that investors seem to be paying for IBM’s brand and stability rather than tangible progress, inflating the stock beyond what its performance warrants.

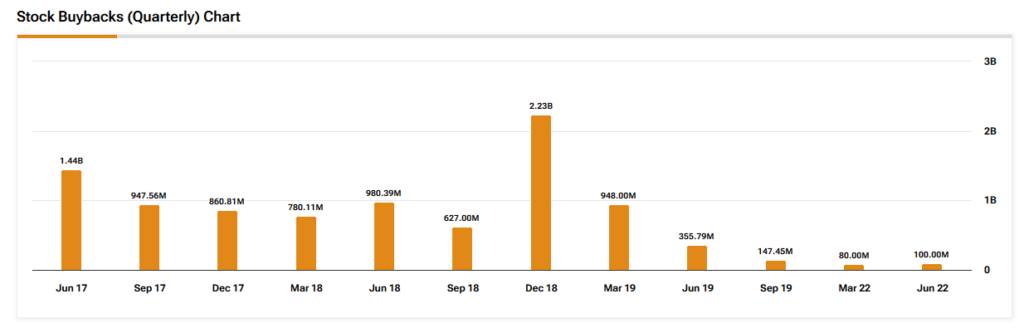

Adding to this concern is IBM’s $58.4 billion debt load, what you can consider to be a hangover from acquisitions, and its infamous overspending on buybacks in the past. Such a massive liability burden limits flexibility, siphoning cash into interest payments that prevent IBM’s profitability prospects from flourishing. While some deleveraging has taken place in recent years, at this pace, it would take decades for IBM to reach a net cash position, which shows just how saddled the balance sheet is. In any case, this is another reason I can’t come to terms with IBM’s valuation at its current levels.

Is IBM a Buy, Sell, or Hold?

As far as Wall Street’s estimates go, IBM stock has a Moderate Buy consensus rating based on eight Buys, six Holds, and one Sell rating assigned in the past three months. At $260 per share, the average IBM stock target suggests a ~4% upside potential.

End of the Road for IBM Stock Bulls

IBM’s century-old reputation and loyal investor base can’t mask its deteriorating fundamentals. Once a dividend powerhouse, its yield and growth have faded. Revenue stagnation persists despite a tech boom, and the stock’s lofty valuation defies its modest prospects. Efforts in cloud and AI haven’t yet sparked a revival, leaving IBM as a low-yield, low-growth, high-priced bet.

For this reason, I believe that selling IBM now offers a chance to lock in gains and redeploy capital into stronger opportunities while it’s near its highs. This is a classic case of an aging tech icon outpaced by its peers, so prudent investors should act before the market does.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue