Tech investors have been riding high in recent years, as surging technology stocks have propelled a powerful market rally. But after two years of solid gains, could the momentum be running out of steam?

Not so fast, says Raymond James analyst Josh Beck, who ranks among the top 1% of analysts on TipRanks. Beck remains firmly in the bullish camp, particularly when it comes to the internet segment, where he sees plenty of room for growth.

“We remain bullish on the internet sector… The year ahead marks a crucible moment for GenAI commercialization as capex concerns could be assuaged as assistant-oriented use cases quickly develop into more agentic flows across consumer/enterprise software and HardTech applications. HardTech, broadly defined, could develop into a more mainstream technology as Robotaxis scale and Humanoid activity ramps. The macro is on steadier footing with 2024/25 real GDP projections of 2.5%/2.1% (vs. 1.4%/1.8% last year),” Beck opined.

Translating his stance into specific recommendations, Beck has tagged two ‘Strong Buy’ tech stocks as potential winners for the coming year. These stocks have already surged 70% or more over the past year – but according to Beck, the rally isn’t over. Let’s take a closer look at his top picks.

Wix.com, Ltd. (WIX)

The first Raymond James pick we’ll look at is Wix, the company that brought the do-it-yourself mindset to the field of web design. Wix is known for its website building platform, which is based on the WYSIWYG (what you see is what you get) concept; users don’t need any experience in coding, computer language, or website architecture, but rather can build a site using a set of intuitive click-and-drag tools. The model has proven popular, and Wix today boasts over 250 million users, in 190 countries, creating more than 85,000 websites every day.

Wix operates on the freemium model, making its basic tools, platforms, and tutorials available to all comers free of charge – with more advanced platform upgrades available by subscription. The model avoids trial periods, letting all users have access to basic services, and attracts subscriptions through the quality of those services. In effect, Wix is its own best advertisement.

Recently, Wix added a business-centric platform to its product line, Wix Studio. This web design platform is purpose-built to meet the needs of enterprise users and clients, and includes features such as automatic scaling and no-code animations. Wix has integrated AI technology into the platform, to give users a set of intelligent tools, and the platform even supports application development. The introduction of Wix Studio marks a shift for the company, towards a more business-oriented clientele.

The company began recording full-year profits in 2023, and continued that into 2024. In its last reported quarter, 3Q24, Wix had a top line of $444.7 million, up 13% year-over-year and some $740,000 over the estimates; the non-GAAP EPS figure of $1.50 was 7 cents better than had been anticipated.

Looking ahead, Wix is expected to report its 4Q24 results this week – analysts are looking for a top line of $461.4 million and an EPS of $1.61. We should note here that WIX shares have gained 72% over the past 12 months.

Turning to analyst Beck and the Raymond James view of Wix, we find that the tech expert is impressed by the Wix Studio product, and writes, “Wix’s new web-building product for agencies, Wix Studio, is gaining significant traction and market share among professional web design agencies (based on agency checks) with over 1M users in less than a year and 75% of new Partner bookings were built on Studio. Wix Studio brings multiple benefits to WIX’s growth algorithm as it attracts more complex website builds from larger, more mature businesses, which tend to purchase higher-value plans, have higher GPV processed online (Partners comprise one-third of accounts but 50% of GPV), and have better retention rates due to a lower chance of failing.”

“That,” according to the analyst, “should help drive a dual acceleration in growth and profitability potentially setting up a multi-year path to a mid-40s RoF with Partners potentially more than 50.”

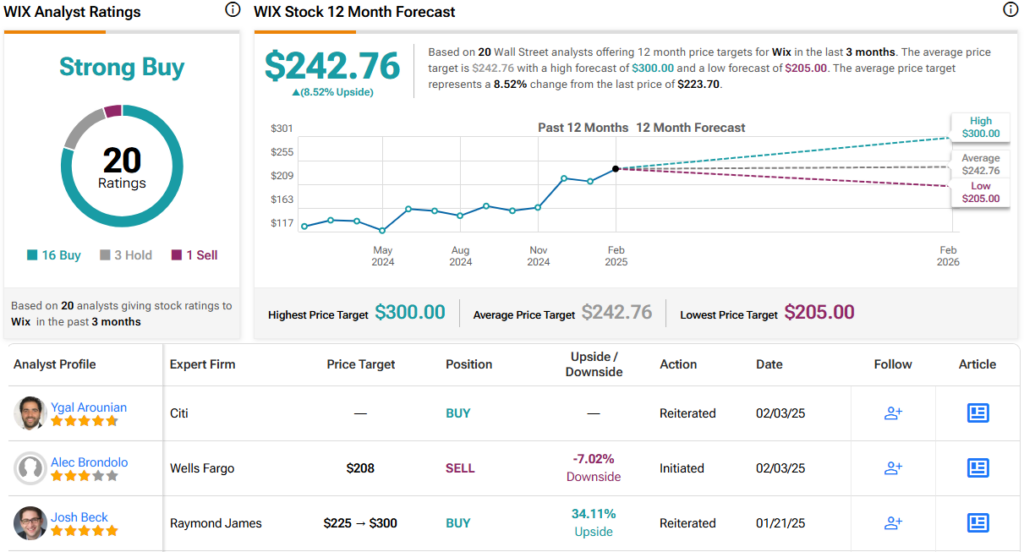

Beck quantifies his stance on WIX with a Strong Buy rating and a $300 price target that implies the shares will gain 34% in the coming year. (To watch Beck’s track record, click here)

Overall, WIX’s Strong Buy consensus rating is based on 20 recent analyst reviews, that break down to 16 Buys, 3 Holds, and 1 Sell. The shares are priced at $223.70 and their $242.76 average price target suggests a one-year upside potential for the stock of 8.5%. (See WIX stock forecast)

Reddit, Inc. (RDDT)

Next on the list is Reddit, the popular user-generated social media content and discussion site. Reddit was founded in 2005 and today boasts more than 101 million daily active users, who participate in a ‘community of communities,’ posting original user content, participating in discussions, and just talking about anything and everything, from news to hobbies to individual passions.

The company went public through an IPO a little less than one year ago and has been an investor favorite since; the stock has seen some outsized gains – up by 318% since it entered the public realm.

Reddit, however, hit a speed bump recently and the stock has pulled back following the release of its 4Q24 results on February 12. In that data set, Reddit reported higher-than-expected R&D expenses, which were up to $188.6 million, and lower-than-expected ‘Daily Active Uniques,’ or DAUq, its measure of daily active users, which was up 39% year-over-year. In addition, Google made changes to its algorithm that caused a negative impact on Reddit’s traffic and DAUq numbers.

Nevertheless, Reddit’s Q4 headline numbers – the revenue and earnings figures – both beat the forecasts. The company’s top line of $427.7 million was up 71% year-over-year and was $22.16 million better than had been anticipated, while the EPS of 36 cents was 11 cents per share over the estimates. The company realized a gross margin in Q4 of 92.6% and of 90.5% for the full year 2024.

In an interesting note, Reddit made it known last week that it will be introducing a paywall around some content over the course of this year. The company’s CEO said that Reddit will be introducing ‘paid subreddits,’ which will contain content only accessible to paying subscribers.

Turning again to Beck, we find that he is upbeat on Reddit, recommending investors make use of a buying opportunity. He says, “Reiterate Strong Buy on RDDT and would be buyers on the pullback as late quarter Google algorithm changes (note Google core update December 12-18) contributed to an unexpected U.S. DAUq miss (48M vs. Street 51.5M) and given the importance of later quarter ad spend likely constrained the upside to a ~5% beat, below our preview that contemplated a ~9.5% beat. Management commentary indicated a sharp DAUq recovery which we think was likely driven by 1) Google benefiting from deeper Reddit crawling 2) Reddit uncollapsing comments in search results, and 3) a potential benefit from spam reduction algo updates (Reddit pre-filters via moderation).”

Referring specifically to the 4Q earnings report, the analyst goes on to say, “While the report did not clear our anticipated bar, we walk away encouraged by international upside (DAUq + ARPU), ad progress (performance, manager, formats) and early positive response from Answers that likely is combined with Search to improve on-platform searchability.”

As noted, Beck put a Strong Buy rating on this stock – and he complemented that with a $250 price target, showing his confidence in a potential upside this year of 27%.

RDDT shares have picked up 19 recent analyst reviews, and these include 13 to Buy, 5 to Hold, and 1 to Sell – adding up to a Moderate Buy consensus rating from the Street. Reddit’s stock is selling for $196.38, and its $206.50 average target price implies that it will gain 5% on the one-year horizon. (See RDDT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.