Persistent economic headwinds – high inflation and high interest rates, declines in real wages, worried consumers – are stoking worries of a ‘hard landing,’ or an economic downturn in the near- to mid-term. While the conventional wisdom is still predicting continued bullish conditions, the savvy investor will set up a portfolio capable of bringing gains no matter what the economic conditions.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

And that outlook will bring the transport stocks to mind. These shares offer some powerful incentives for investors. They come from the real economy, representing the movement of real goods and services. Transport won’t be trendy, but it will always be relevant. Every other economic sector depends on it. No matter what happens, chances are that at least some aspect is trucked into position.

And this brings us to another advantage of the transport stocks. The economy will always rebound from a downturn, and when it does, the transport companies are ideally positioned to recognize early gains. This is a sector that could be tailor-made for long-term positions.

Taken together, these factors underlie a recent Raymond James note on transportation stocks. The investment bank sees opportunity brewing in the transport sector, based on the combination of current conditions and probable outlook. Analyst David Hicks has laid out the case and picked two transportation stocks in particular.

We’ve used the TipRanks platform to pull up the details on his picks, to find out what else makes them compelling choices today.

Knight-Swift Transportation Holdings (KNX)

We’ll start with a trucking company, a major name in the North American transport scene. Knight-Swift is a holding company, based in Phoenix, Arizona and operating in the transport sector through several subsidiaries. These include Knight Transportation, Swift Transportation, and Midnite Express, which all focus on carrying full truckloads, as well as several less-than-truckload (LTL) haulers.

Knight-Swift, which has a market cap of $7.6 billion, boasts that it is the largest full truckload company in the industry, and the numbers back this up. The company employs some 24,000 people, and operates approximately 19,000 tractors and 58,000 trailers. Knight-Swift can provide customers with complete truckload, LTL, and logistic services, as well as intermodal transport services, across the US, Canada, and Mexico.

Trucking is big business, and Knight-Swift brought in a total of $1.82 billion in revenues during 1Q24, the last quarter reported. While the quarterly revenue just missed the forecast by $10 million, it was up 11% year-over-year. The revenue gain was attributed to new business from the company’s acquisition of the LTL company US Express, a transaction that was made effective on July 1, 2023. The bottom line was not as impressive, however. Knight-Swift reported a non-GAAP EPS of 12 cents, missing the forecast by 7 cents per share – and falling sharply from the 73-cent EPS reported in 1Q23. Management noted that the EPS in Q1 suffered from the cessation of the company’s third-party insurance business, which would otherwise have added 8 cents per share to the EPS.

Despite the year-over-year drop in earnings, the company still felt enough confidence to declare, on May 1, a 16-cent per common share dividend payment. This was the second declaration in a row at that rate, and marks a 2-cent increase from the year-ago dividend. The forward yield of the dividend is modest, at 1.3%, but the reliability is high; Knight-Swift has been paying out dividends since 2004, and has been slowly increasing the payment since 2020.

Watching this transport company from Raymond James, analyst Hicks notes that Knight-Swift’s moves into the LTL segment and away from third-party insurance both bode well for the company’s performance going forward. He writes, “Although we are of the view that the TL market inflection will take time to develop given a cloudy demand environment and still resilient TL supply base, we view KNX as one of the most idiosyncratic stories in our transport coverage due to its recent entrance into the structurally sounder LTL market given supply constraints; the turnaround story brewing at the recently acquired U.S. Express as KNX leverages its scale and implements best practices at the beleaguered TL operator; and exit from its third-party insurance business, which helps derisk Knight-Swift from a rising tide of nuclear verdicts in the trucking industry.”

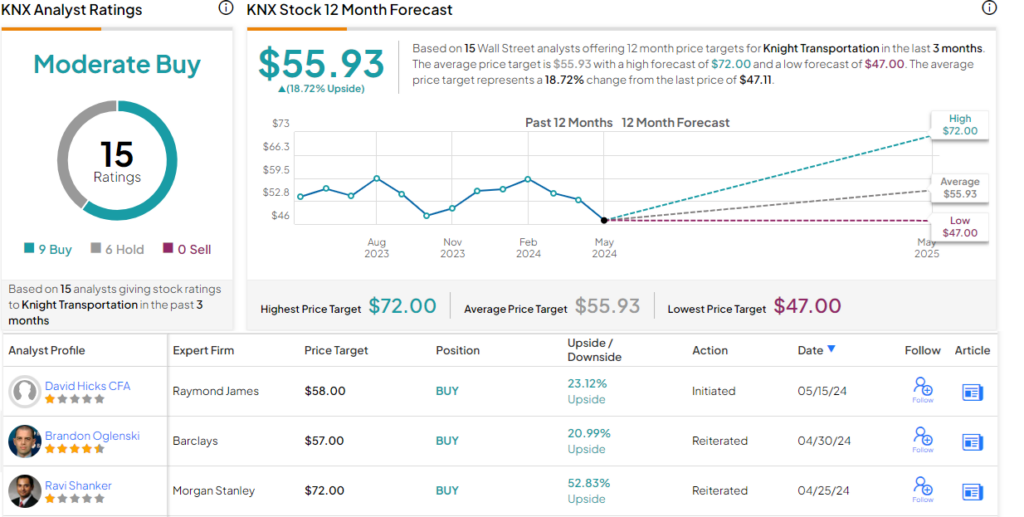

Following from this stance, Hicks rates Knight-Swift as a Strong Buy, and his $58 price target points toward a one-year upside potential of 23%. (To watch Hicks’ track record, click here.)

Turning now to the rest of the Street, where KNX shares have a Moderate Buy consensus rating, based on 15 recent reviews that include 9 to Buy and 6 to Hold. The stock is selling for $47.11, and its $55.93 average price target implies it will gain 19% in the year ahead. (See KNX stock forecast)

Marten Transport (MRTN)

Tracing its roots to a milk truck in rural Wisconsin, back in 1946, Marten Transport today is an international, multimodal trucking and logistics company capable of serving customers – both shippers and carriers – across all of North America. The company operates a fleet of some 3,500 tractors, based out of more than 20 US terminals, and employs over 4,400 people, moving goods where they are needed, when they are needed.

Marten prides itself on offering specialized services, including meeting time-sensitive distribution, refrigerated trucks, dry vans, surge flexibility when customers need to expedite loads, and cross border door-to-door service in the US, Canada, and Mexico. The company is committed to making the trucking industry more environmentally friendly, and has developed solar power installations at 15 of its terminals, and on a large portion of its fleet.

In the recent 1Q24 earnings release, company management noted that the transportation industry is currently facing a combination of oversupply and weak demand, while inflation pushes operating costs upward. In this difficult environment, Marten’s top and bottom lines in the quarter both missed the forecasts; revenue, at $249.7 million, missed by $14.16 million while slipping 16% year-over-year, and the bottom line EPS of 12 cents per share was 2 cents lower than expected. At the same time, the company finished the first quarter with more than $73.7 million in cash on the books, an increase of more than $20 million from the end of 4Q23.

Like Knight-Swift above, Marten pays out a dividend. The company started making the payments in 2010, and has not missed a quarterly payout in that time. The current dividend, declared at 6 cents per share on May 7 for a June 28 payment, has been held at its current level for 10 quarters and provides a forward yield of 1.35%.

In his coverage of Marten, analyst Hicks notes that the company has several advantages as it navigates a difficult freight landscape. These include the company’s defensive posture, clean balance sheet, and cross-border business, as well as its quality manpower pool. Hicks writes, “While concerns about the freight cycle continue to swirl (when will the upcycle occur and just how good will it be), Marten is more insulated from the cycle relative to its peers given a contract centric book of business and more defensive positioning via a pristine balance sheet and temp controlled orientation. That said, it has not been standing still throughout one of the worst freight downturns in recent memory, as it continues to invest in growth opportunities through deeper penetration into the much larger dry van market, takes advantage of highly accretive cross-border Mexico shipments that are benefiting from the early stages of reshoring, and continues investment into its driver base, further preparing the company for when the cycle does start to turn for the better.”

These comments support the analyst’s Outperform (Buy) rating here, and his price target, set at $20 per share, implies a 12% potential upside for the year ahead.

There are only two recent analyst reviews on file for Marten, but both are positive – giving the stock a Moderate Buy consensus rating. The stock is selling for $17.88 and has an average price target of $20.50, suggesting a 14.5% gain on the one-year horizon. (See MRTN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue