The race for AI supremacy has taken an unexpected twist as Chinese AI startup DeepSeek’s latest AI model, which is both affordable and capable of operating efficiently on less-advanced chips, has sent US stocks into a tailspin early Monday, raising concerns China could potentially outpace the U.S. in the AI game.

While the market went into shock mode on this development, there’s no doubt the new tech has opened up huge opportunities for investors, especially in software and data centers – but the ripples in the digital ocean are only beginning to spread out. New opportunities are coming up, as investors begin to see the secondary effects of the AI boom, and the way it trickles down into unexpected sectors.

Stifel analyst Tore Svanberg has been watching the opportunities spread out from AI’s initial splash, and in a recent note he sums up what it means for investors.

“We continue to recommend investors Overweight AI-related stocks… While we recognize the current valuation differential between ‘AI Names’ vs. ‘Cyclical Names’, we do not see any catalysts during the 4Q24/1Q25 earnings season that could potentially alter this dynamic… AI segments are showing resilience and strength, leading to a continuous binary environment for the companies in our coverage,” Svanberg opined.

Svanberg and his colleagues at Stifel have taken the next logical step and are making specific recommendations on just which AI-related stocks to buy. To dig deeper, we turned to the TipRanks platform to uncover Wall Street’s broader perspective on these Stifel-endorsed picks. Here’s what we found.

Monolithic Power Systems (MPWR)

We’ll start with a company that combines two of AI’s most important components – power and semiconductor chips. Monolithic Power Systems bills itself as a provider of ‘high-performance, semiconductor-based power electronics solutions.’ The company is known for its expertise in semiconductor design, and its innovations in integrating semiconductor chips with power management and distribution systems. Monolithic’s product line includes power modules and converters, motor drivers, sensors, electronic inductors, and battery management systems, to name just a few – all are vital components in power management systems, providing reliable solutions for energy efficiency and cost-effectiveness in power-hungry applications.

Those applications are widespread. Monolithic’s products can be found in a broad range of tech sectors, including optoelectronics, telecom, IoT – as well as AI data centers and cloud computing. The company has purposely taken a diverse approach to its products and their applications, allowing for broad use with a wide-ranging customer base, including a large number of OEMs in various economic segments.

While this has been a successful strategy, we should note that Monolithic saw its share price tumble toward the end of last year, both on a Q4 outlook that disappointed and due to the delays in the shipments of Nvidia’s new Blackwell chips. Monolithic had a large allocation to the Blackwell line, and the delays created a serious risk to Monolithic’s work backlog.

That said, the company’s 3Q24 results did beat the forecasts. The company’s total quarterly revenue, of $620.1 million, was up 30% year-over-year – and it beat the forecast by $19.7 million. At the bottom line, Monolithic’s non-GAAP EPS of $4.06 was 9 cents per share better than had been expected. Yet looking ahead, the company guided toward Q4 revenue in the range of $600 million to $620 million; the $610 million midpoint was only slightly higher than the $607.7 million consensus figure and showed an expected sequential decline.

Tore Svanberg covers this stock for Stifel, and he is not worried about the recent decline in share price. The analyst, who is rated by TipRanks in the top 2% of Wall Street’s experts, points out Monolithic’s diverse product line as a key benefit, writing, “We believe MPWR remains well-positioned to benefit not only as a key power management supplier for AI infrastructure, but also as a supplier of an impressively diverse suite of products targeting multiple end markets. Indeed, we believe MPWR remains well-positioned to benefit not only as a we note the potential accretion from AI-related ‘trickle-down’ opportunities in Communications, Automotive, and Consumer in both the medium- and long-term. NT, however, broad-based analog (non-DC) remains somewhat soft and while we expect MPS to fare better vs. peers, it could potentially weigh on the Mar Q outlook.”

Looking ahead, the top-rated analyst adds, “We believe MPS can continue to outperform the broader analog markets by a wider margin long-term on further share gains, based on the company’s continuous design win momentum (including Tier 1 OEMs for server, storage, AI, and automotive). Given its unique ability to offer highly integrated solutions, we also believe large Tier-1’s are growing increasingly reliant on MPS to solve complex power management issues across multiple end applications.”

For Svanberg, this justifies a Buy rating for MPWR, and his $1,100 price target suggests that the stock will gain 62% in the year ahead. (To watch Svanberg’s track record, click here)

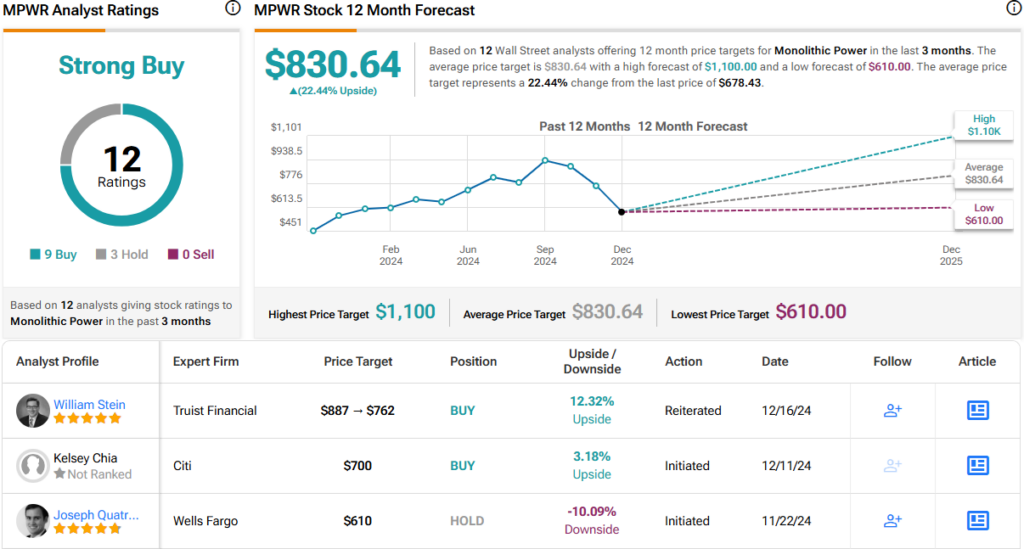

Monolithic has picked up 12 recent Wall Street reviews, and the 9 to 3 split favoring Buy over Hold supports the stock’s Strong Buy consensus rating. The shares are currently trading for $678.43 and have an average price target of $830.64, implying a 12-month upside potential of 22.5%. (See MPWR stock forecast)

ServiceTitan, Inc. (TTAN)

Next up is ServiceTitan, a tech company that has found a unique niche. ServiceTitan has developed a cloud-based software platform dedicated to the needs of tradespeople and craftsmen, offering them an operating system purpose-built to meet the specialized needs of sales, customer service, marketing, and data analytics in the trade fields. Users can monitor and track all sorts of activities, including contracts, scheduling, job costing, booking, payroll, and dispatching: all of the day-to-day activities that eat up time and money for contractors.

The company was founded in 2007, and since then it has grown its customer base to more than 100,000 contractors in a wide range of trades covering a variety of construction and maintenance professions. The company offers its software platforms—it has developed several, with various features catering to specific customer needs and niches—in both home and commercial versions, to meet the needs of both large and small businesses.

This past October, ServiceTitan unveiled a set of new AI-powered tools backed up by the firm’s in-house AI solution, Titan Intelligence. The new AI features include solutions for contact centers, sales, and general user assistance, with the AI able to conduct predictive insights, risk analysis, and software automation. Titan Intelligence was first released in 2022 and has become an important feature of the company’s product lines.

Investors should note that ServiceTitan is a stock new to the public markets. The company held its IPO in December of last year and raised $625 million in the offering.

Earlier this month, the company announced its fiscal 3Q25 financial results, its first such public release since the IPO. The results covered the quarter ending on October 31, 2024. In the results, ServiceTitan showed a top line of $199.3 million, up 24.5% year-over-year and $760,000 better than had been expected. The company ran a net loss in fiscal Q3 of $1.74 per share by GAAP measures. This net loss missed analysts’ forecast by 38 cents per share.

Terry Tillman, another of Stifel’s 5-star analysts, covers this newly public stock, and he sees plenty of reason for investor optimism. In his write-up on TTAN following its FQ3 results, Tillman said, “We believe continued execution against well-managed guides, and consistent but viable raises are the most critical aspect in establishing this ‘rhythm’ and TTAN took the first step in that direction… While the conservatism in the model was understood, we were pleased to see the magnitude of the F4Q raise, and expect to see upward revisions to Street estimates for FY26-27. Upside in the quarter was attributed to steady execution and Pro & Usage strength. We continue to see a long-term opportunity for ServiceTitan to continue to execute, particularly against those specific vectors.”

Tillman goes on to give TTAN shares a Buy rating, which he complements with a $120 target price that points toward an upside potential of 22.5% on the one-year horizon. (To watch Tillman’s track record, click here)

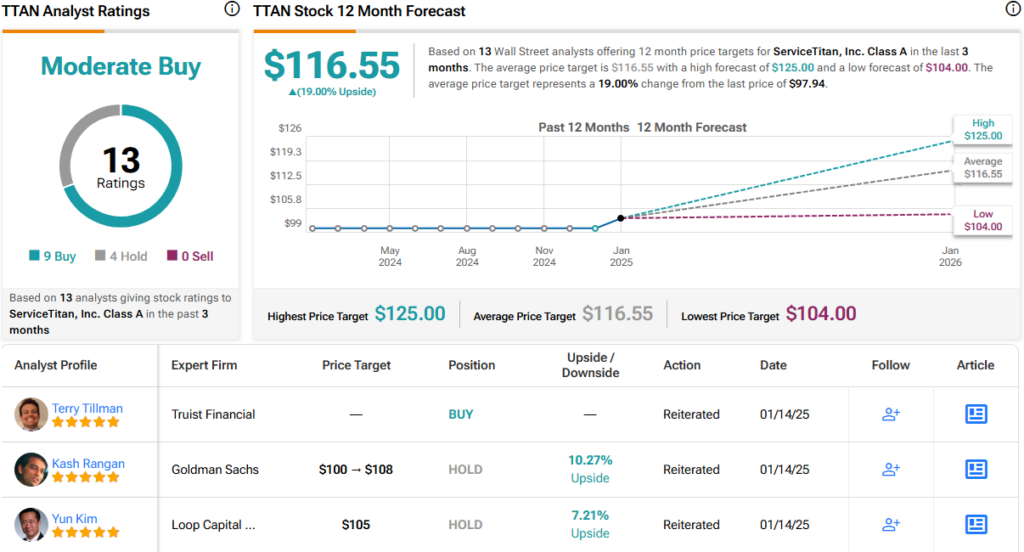

In its short time in the public markets, TTAN has acquired 13 analyst reviews. These include 9 Buys to 4 Holds and back up the Moderate Buy consensus rating. The shares are priced at $97.94, and their $116.55 average target price indicates a potential one-year gain of 19%. (See TTAN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.