An idiosyncratic indicator – the aggregate market cap of US stocks compared to the total GDP, a measure favored by Warren Buffett – is approaching 200%, the level which the Oracle of Omaha says suggests danger on the way.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

“”For me, the message of that chart is this: If the percentage relationship falls to the 70% to 80% area, buying stocks is likely to work very well for you. If the ratio approaches 200% — as it did in 1999 and a part of 2000 — you are playing with fire,” Buffett stated in a Fortune Magazine article published back in December 2001.

None of this means that the bull market is over, but when such an indicator starts flashing, maybe it’s time investors start looking into defensive stock plays.

BTIG’s Thomas Catherwood would appear to agree. The analyst has been pointing out dividend stocks for investors to buy now, and his picks offer defensive-minded investors up to 12.5% dividend yields. Let’s take a closer look.

Blackstone Mortgage Trust (BXMT)

The first stock on our list is a real estate investment trust, a REIT, associated with a well-known asset manager. Blackstone Mortgage Trust is backed by the larger Blackstone asset management company, and uses that affiliation to identify opportunities and to connect with financial partners. That makes a sound backing for this REIT, whose business focuses on mortgage loan packages and mortgage-backed securities rather than direct real estate ownership. Blackstone Mortgage Trust targets its investments in the North American, European, and Australian markets, and has a portfolio of 173 loans worth more than $21 billion.

The company’s loans fit a basic set of parameters. They are typically first mortgage collateralized, and worth upwards of $50 million each. Geographically, the company has operations in 13 US states, as well as the UK, Ireland, Spain, Germany, and Sweden, along with Australia.

On the financial side, Blackstone Mortgage Trust’s Q1 results for this year, the last set reported, showed a non-GAAP EPS of 65 cents. This was 21 cents per share better than had been expected – but for dividend investors, the key point is that the EPS fully covered the company’s 62-cent common share dividend payment. This dividend was last declared on June 27, and was paid out on July 15. The annualized rate, at $2.48 per common share, gives a forward yield of 12.6%.

BTIG’s Tom Catherwood has written up his firm’s coverage of this stock, and he notes the quality of the portfolio as a main attraction: “BXMT is the largest pure-play transitional lender in our cmREIT coverage… While the company (like all other cmREITs) has faced headwinds from the impact of higher rates on asset-level cash flows, we view the connection to the largest global real estate investment platform as an unparalleled advantage as BXMT manages its loan book, maximizes value of owned assets, and looks to make incremental investments.”

Catherwood adds, of BXMT’s potential, “While shares trade at a premium to our coverage universe (79% of BV vs. 72% overall), they remain at a discount to their long-term average (94% of BV), which we believe provides an attractive entry point as the company addresses legacy assets and looks to originate new loans.”

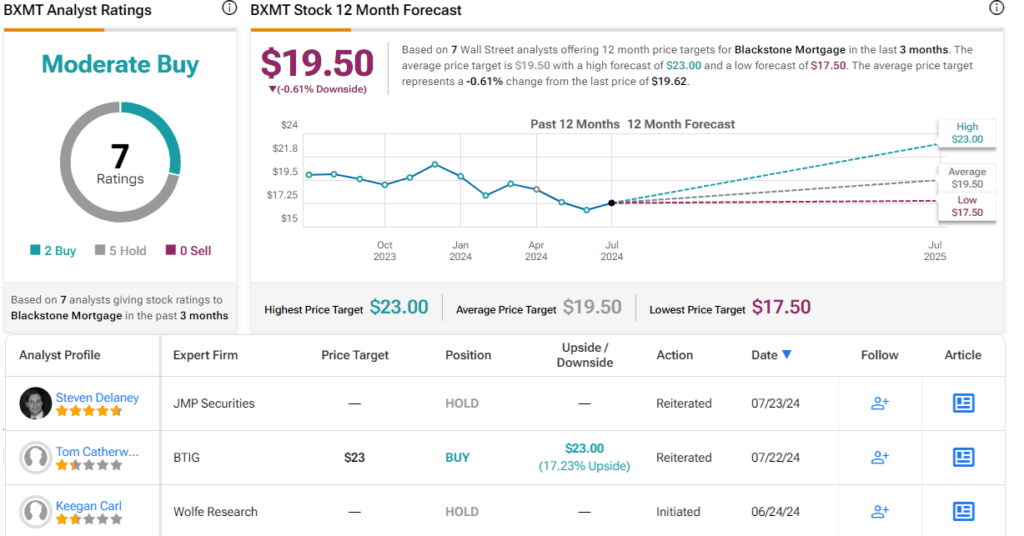

These comments back up a Buy rating, while the analyst’s $23 price target points toward a gain of 17% on the one-year horizon. Combined with the forward dividend yield, this could add up to a total one-year return of more than 29%. (To watch Catherwood’s track record, click here)

There are 7 recent reviews of this REIT stock, and they include 2 Buys to 5 Holds for a Moderate Buy consensus. BXMT’s $19.50 average price target implies the shares will stay rangebound for the time being. (See BXMT stock forecast)

TPG RE Finance Trust (TRTX)

The second stock we’ll look at is TPG RE Finance, also a REIT and one that focuses on the commercial real estate segment. As a company, this REIT is sponsored by TPG, the global alternative asset firm controlling some $120 billion in assets. TPG RE Finance Trust operates as the larger company’s Real Estate segment, and in that role, it has decades of experience as a commercial real estate lender, holding long-term relationships with brokers, operators, and equity providers. TPG RE Finance supports these operations with access to the larger firm’s asset platform.

Narrowing the focus to the specific operations of TRTX, we find that the company operates in the top 25 US real estate markets across all major asset classes, making loans greater than $50 million. As of the end of 1Q24, the company’s portfolio was valued at $3.5 billion. The portfolio made up of 50% multifamily residential (apartment properties), more than 20% office space, 11% in life sciences-related properties, and nearly 10% in hotel properties. The remainder is made up of self-storage, industrial, and multi-use commercial properties. Geographically, nearly 37% of the company’s portfolio investments are in the West, mainly California, while more than 30% are in the East, mainly Florida and in the corridor from Northern Virginia to Philadelphia.

The last quarterly results released by TRTX cover the first quarter of this year and showed a net income, by GAAP measures, of 17 cents per common share, beating the forecast by a penny. The company had $371 million in available liquid assets at the end of the quarter and had a book value, per common share, of $11.81.

This past June, TRTX declared a common share dividend payment of 24 cents, for payment on July 25. The current dividend annualizes to 96 cents per common share and gives a forward yield of 10.15%.

In his coverage of this REIT for BTIG, analyst Catherwood is clearly impressed by the firm’s strong strategic position. He writes, “While TRTX had to go through a fair amount of pain in 2023, the company came out the other side in a solid position, with no 5-rated or non-performing loans or specific CECL. This has placed TRTX in an advantageous position of being able to go back on offense (albeit at a lesser level than previously) while many of its peers are forced to focus on challenged loan books, added non-accruals, and REO challenges. Indeed, the company originated three loans with total commitments of $116.3M and an initial UPB of $107.0M in 1Q.”

Looking ahead, Catherwood adds of the stock, “For the rest of 2024, we believe TRTX will stay on the front foot, and continue to originate new loans, leading to a slight increase in the company’s loan portfolio by year-end.”

For Catherwood, this adds up to a Buy rating on the shares, and his $11 price target indicates a one-year upside potential of 17%. Add in the dividend yield, and the return on this stock can exceed 27% in the next 12 months.

That’s a decent potential return, but the Street is clearly not ready to go all the way on TRTX just yet. The shares have a Hold consensus rating, based on an even split of 1 Buy, 1 Hold, and 1 Sell review set in recent months. (See TRTX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue