American Airlines (AAL) has taken a 35% beating so far in 2025, falling to record lows last seen 18 months ago. While lackluster guidance, looming tariffs, and pilot shortages weigh on investor sentiment, AAL’s potential for record free cash flow this year and aggressive debt reduction tell a rather bullish story. With increasing travel demand, today’s steep discount makes the stock a steal for patient investors who can withstand the ongoing turbulence to reach clearer skies later this year.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

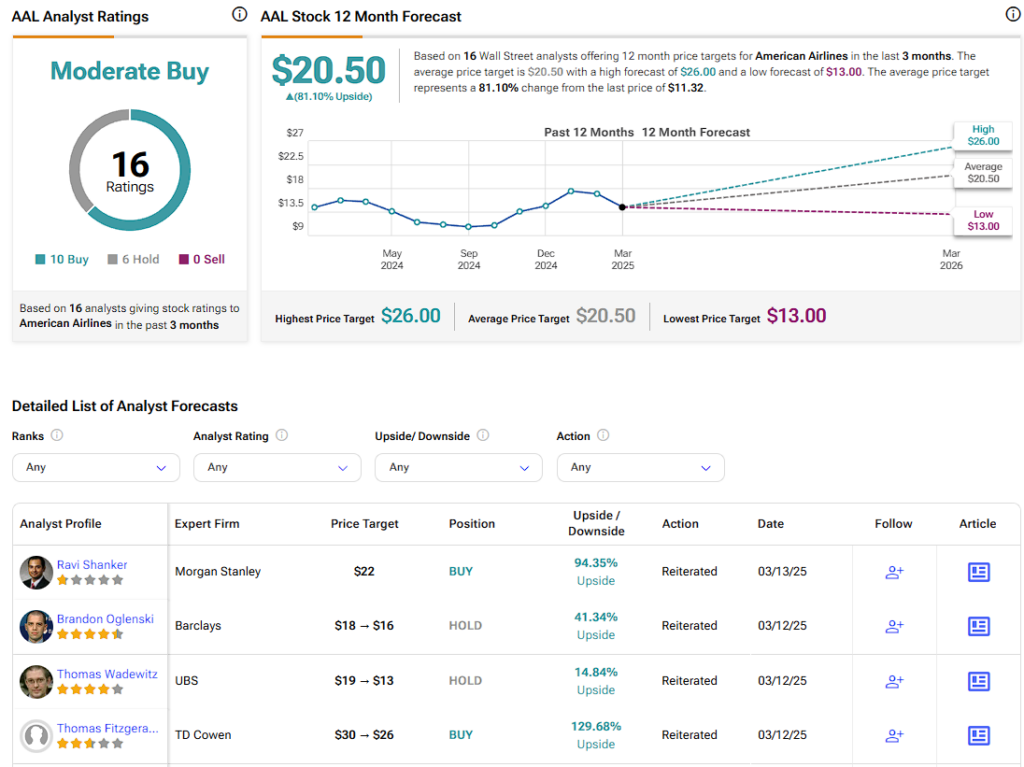

I maintain a bullish position similar to several Wall Street analysts, including Ravi Shanker from Morgan Stanley, Brandon Oglenski from Barclays, and Thomas Wadewitz from Swiss bank UBS.

Why AAL Stock Is Down Lately

American Airlines’ violent decline can be traced back to Wall Street’s lukewarm reception of its Q4 earnings. Although the airline posted a record $13.7 billion quarterly revenue, management’s outlook for early 2025 was less than euphoric. Rising labor costs, a potential dip in demand, and looming capacity adjustments all fueled doubts about whether AAL can sustain its momentum. Pilot shortages and elevated training expenses haven’t helped, intensifying concerns that profitability could face ongoing pressure.

Another factor magnifying the selloff is the broader market selloff triggered by President Trump’s fresh tariff war. Investors, wary of potential consumer and corporate travel slowdowns, moved swiftly to reduce exposure to cyclical sectors. With airlines often viewed as riskier bets in market uncertainty, American Airlines stock felt the brunt of that shift. The result is a share price close to multi-year support levels, prompting many to wonder if the market has overcorrected.

Encouraging Trends Beyond the Headlines

Despite the cautionary talk, I think it would be wise to focus on American Airlines, which has shown several strengths. Last year, the company generated a record $2.2 billion in free cash flow, exhibiting its capacity to navigate turbulence. This robust liquidity influx enabled AAL to retire debt ahead of schedule, beating a $15 billion reduction target a full year early. This is important because such debt reduction efforts are crucial for an industry known for heavy capital expenditures and razor-thin margins, positioning AAL well should the sector remain in turmoil.

In another interesting development, management has hyped the soon-to-launch ten-year co-branded credit card partnership with Citi (C). Set for 2026, it could be quite the game changer for the airline’s loyalty revenues. If successful, we should expect the co-branded card to spark a more diverse revenue mix that will mitigate the ups and downs of ticket sales alone.

Moreover, the airline has been working to mend and strengthen relationships with corporate travel agencies, aiming to capture more of the lucrative business traveler segment. So, should the industry see better days in the coming quarters, these proactive moves have set AAL up for its next growth phase.

Bargain Territory or Value Trap?

American Airlines’ sharp year-to-date decline has pushed its forward multiples down to levels you can hardly call anything other than a bargain. Consensus estimates point to EPS of $2.06 in FY2025 and $2.85 in 2026, suggesting growth rates of about 5% and, even better, 39%, respectively. At current levels, those figures translate into forward P/E ratios of roughly 5.3x for 2025 and 3.8x for 2026. Even for an industry that often trades at discounts because of its cyclical nature, these multiples are incredibly depressed. Looking at some of AAL’s peers indicates the company is at the top of its field, with only Alaska Air (ALK) and United Airlines (UAL) offering similar investor value.

Critics may quickly note that airlines deserve cautious multiples due to unpredictable operating environments. Yet AAL’s proven ability to generate cash flow and methodically reduce debt casts doubt that it should remain so heavily discounted. This is especially true considering that Wall Street’s free cash flow projection for 2025 stands at $1.72 billion, suggesting another year of ample liquidity and capital allocation deployment option openings. Given the confluence of price and value, AAL stock may be poised for a market re-rating over the next few years.

Is American Airlines a Good Stock to Buy?

Despite the bearish trend in recent months, analysts are bullish on AAL’s investment case. Over the past three months, American Airlines has gathered ten Buy, six Hold, and zero Sell ratings, obtaining a Moderate Buy consensus on Wall Street. Currently, AAL stock carries an average price target of $20.50 per share, implying a staggering ~81% upside potential from current price levels.

AAL Stock Languishes On the Runway for Takeoff

American Airlines’ 35% decline in the first three months of 2025 may look alarming at first glance. However, current valuations present an intriguing entry point for investors who can stomach short-term gyrations as broader macro themes amplify the short-term noise. The current focus on free cash flow and debt reduction tells me this is a well-positioned airline ready to capitalize on today’s rising travel demand trends. In the meantime, if management’s initiatives around loyalty partnerships and corporate travel gain traction, AAL could emerge stronger once external pressures abate.

Of course, the big question is whether these catalysts can genuinely take flight with ongoing uncertainties, like tariff risks, labor negotiations, and potential lulls in discretionary consumer spending waiting in the wings. Airlines have come back from far worse, while economic cycles are nothing new. Matured carriers like AAL can adapt to fluctuations in consumer spending by staying scalable and nimble. If AAL delivers on its growth plans and broader macro worries recede (as they usually do), its currently depressed valuation won’t be grounded for long.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue