Amid the market turmoil following Trump’s “Liberation Day” tariffs, Nvidia (NVDA) took a hit as a symbol of risk-on-stock investing and global trade. This week’s stock rout extends the GPU maker’s losses to almost 25% so far this year. While Nvidia’s long-term outlook remains bullish—thanks to its dominance in the GPU market, impressive margins, and attractive valuations—it’s still a highly volatile stock. For investors not ready to hold for several years, passively owning shares in the hope of a new rally might be risky.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Even with Nvidia’s pristine fundamentals, the growth story could face challenges due to newly established tariffs and potential supply-cost constraints. Momentum indicators suggest this may not be the best time to own shares but rather to wait for a more favorable entry point. With tariffs looming and risk factors brewing, I’m taking a step back to a neutral stance on Nvidia.

A Quick Overview of Trump’s Tariffs

Before diving into Nvidia’s story, it’s worth mentioning some basic economic concepts that explain how a trade war can affect the stock market and the broader economy.

In simple terms, market prices are determined by the interaction between supply and demand. When a tariff gets in the way, it raises the cost of imported goods, which leads to a decrease in the supply of those goods because producers face higher costs. As a result, prices go up (inflation), and the quantity consumed drops.

The widespread effect of tariffs is a reduction in the economic value generated in the market. While the government may collect more funds in tariff revenue, this doesn’t fully offset the loss of value elsewhere in the broader economy.

As a result, very few in the equity markets can avoid the adverse effects of tariffs. In a nutshell, a trade war typically destroys economic value, and countries involved usually experience higher prices, reduced consumption, lower investment, and higher unemployment. These factors, in turn, tend to severely impact stock prices.

Why Nvidia Is Particularly Vulnerable to Tariffs and Political Tensions

Since trade wars tend to hurt global equities, Nvidia, the largest GPU manufacturer globally with a beta of 2.4 (more than twice as volatile as the broader market), was expected to be first and foremost hit. The more exposure a company has to international imports and exports, the more threatened it becomes during a trade war that sees rising tariffs in its primary markets. Unsurprisingly, when the S&P 500 takes a hit, Nvidia tends to get hit even harder.

Nvidia’s recent poor performance, which has been going on for at least the past three months, is mainly due to a combination of factors, particularly the ongoing U.S.-China political tensions. Since about 13% of Nvidia’s revenue comes from China, Trump’s tariffs are significant.

The key points to consider include U.S. export restrictions, which limit Nvidia’s access to the Chinese market, and China’s new efficiency rules, which could disqualify some of Nvidia’s products, particularly its processors.

Additionally, the Taiwan issue is worth noting. While Taiwan’s chip industry was exempted from the latest round of U.S. tariffs—including a hefty 32% tariff on Taiwan—this is a positive sign for Nvidia. However, it’s not something investors should stop worrying about just yet. Nvidia is highly dependent on Taiwan Semiconductor (TSM) to manufacture most of its products, and any disruption in that relationship could cause major supply chain issues, which would be a big downside for Nvidia investors.

Timing an Investment in Nvidia Stock

Although many yellow flags have been raised about Nvidia recently, it’s worth noting that the stock is currently trading at a forward price-to-earnings ratio of 24x, which is close to the lowest it’s been in several years. This suggests that many of these risks have already been priced in.

Considering that the demand for GPUs—driven by the ongoing AI revolution—still shows no signs of slowing down despite tariffs possibly acting as a headwind in the coming quarters. Nvidia’s long-term growth prospects make the stock look very attractively priced.

For the next three to five years, Nvidia is expected to grow EPS at a CAGR of 35.4%, well above the ~27% growth it experienced over the last five years. This would put Nvidia’s PEG ratio at just 0.7x, meaning it’s relatively de-risked for long-term investors.

That said, Nvidia is a volatile stock, and investors looking for the right time to enter or exit may want to monitor its long-term moving averages. A strategy that makes sense could be owning Nvidia when it’s above its 200-day moving average and selling when it’s below that level. This approach could help avoid further downside as the stock faces headwinds.

Currently, Nvidia’s 200-day moving average is $127.38, which suggests that now might be a good time to sell. For those who have held Nvidia over the past couple of years, it could be a good opportunity to trim positions, take profits, and wait for a more favorable window to re-enter.

Is Nvidia a Buy, Hold, or Sell?

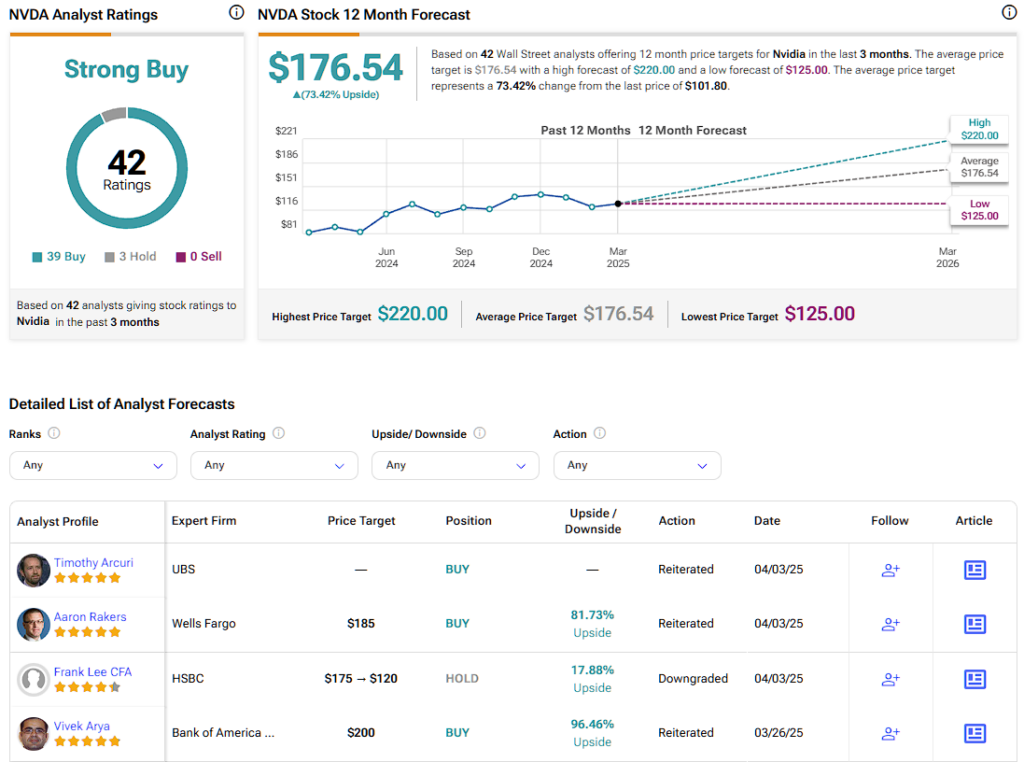

Amid the market turmoil, the bullish consensus around Nvidia remains rock solid. Of the 42 analysts covering the stock over the last three months, 39 are bullish, while only three remain neutral. NVDA’s average price target is $176.54 per share, implying a 73% upside potential.

Short-Term Speculators Beware

It’s hard to be anything but bullish on Nvidia, as the company continues to perform exceptionally well, and demand for AI shows no signs of cooling. However, it’s important to acknowledge that in the short to medium term, Nvidia could be severely scathed by Trump’s tariffs. This could lead to a destruction of global economic value, which would negatively impact a company like Nvidia, which has been rapidly capitalizing on global AI secular growth.

Although valuations, when adjusted for growth, suggest that Nvidia is undervalued and that eventually, in the long term, it will have to generate alpha, for those who are not willing to hold Nvidia stock for several years, now is not the time to initiate long positions.