It’s no secret that 2023 has, so far, been a good year for investors. Stocks are showing strong gains – more than 16% on the S&P 500, and double that on the tech-heavy NASDAQ. It’s a dramatic turnaround from the bear market that plagued investors last year.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

These gains, and the overall positive outlook, were laid out clearly by Deutsche Bank’s head of global economics and thematic research, Jim Reid. In his recent note, Reid recalls the worries from the start of the year but looks forward to the second half, writing, “At the start of this year, we expected H1 to be favorable for risk assets but anticipated that problems would arise as the recession approached in the later half of H2. H1 has surprised on the upside, largely due to tech and AI, but if the start of 2022 marked the beginning of a new higher rates era, then these returns should be seen in that context. The more positive interpretation would be that we had a one-off rate shock that the market sharply adjusted to, and now we are in the process of normalizing and can continue to leave the shock behind us as we progress through the quarters ahead.”

Against this backdrop, the research analysts at Deutsche Bank have been searching the market for the ‘right’ buys, and their picks bear a closer look. They’ve been tapping high-yielding dividend stocks as an investment play of choice. These stocks offer plenty of return potential – one of the DB picks here is yielding 19% right now. Let’s take a closer look.

Westlake Chemical Partners (WLKP)

The first high-yielding dividend pick is Westlake Chemical. This firm spun off from its parent company, the Westlake Chemical Corporation, in 2014, taking its parent’s ethylene business public in its own right. Today, Westlake Chemical Partners has a network of assets and operations across several states, including production facilities in Kentucky and Louisiana, and a 200-mile ethylene pipeline across East Texas.

The Houston-based company has an annual production capacity of some 3.7 billion pounds, and its ethylene is used to produce several derivatives, including polyethylene (PE) and polyvinyl chloride (PVC). These derivative chemicals are used in a wide range of end products with applications in transportation, construction, and packaging.

The story for Westlake is all about cash flow, even while net sales and earnings have slipped. The company reported total revenues for 1Q23 of $307.7 million, missing the forecast by $86.3 million and slipping 15% year-over-year. The bottom line figure came in at 42 cents per share by non-GAAP measures; this was down from 46 cents in the year-ago period – and was 4 cents below the estimates.

The company’s cash flows, however, remained strong. Westlake reported $104.6 million in total assets at the end of Q1, compared to $64.8 million at the end of 2022. The quarterly net cash from operations, reached $144.9 million, up from $104.8 million in net operating cash in 1Q22.

The combination of positive earnings and solid cash flow supported Westlake’s regular quarterly dividend payment, which was declared at 47.14 cents per common share for Q1. This marked 35 consecutive quarterly dividend payments for Westlake. The annualized rate, at $1.88 per share, gives a robust yield of 8.7%.

This stock is covered by Deutsche Bank’s 5-star analyst, David Begleiter, who is impressed by the company’s combination of dividend and cash flows. Begleiter writes, “[The] stable distribution is due to WLKP’s long-term ethylene sales agreement with [the parent company] Westlake… We remain confident that WLKP will continue to offer a distinctive investment opportunity different from other MLPs due to its: i) stable cash flow insulated from commodity price risks; ii) strong balance sheet underpinned by prudent management of cash and leverage metrics; and iii) strategic alignment with its investment grade parent.”

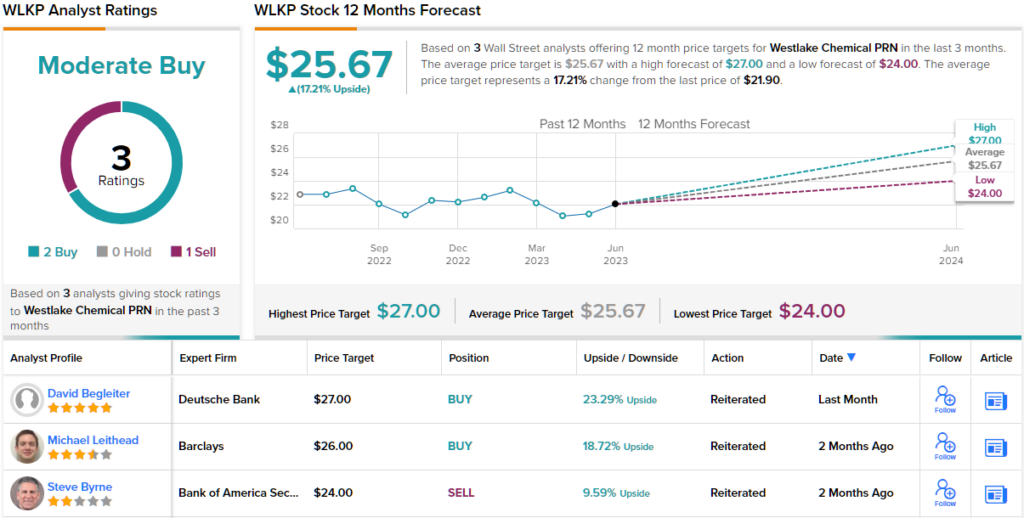

In line with these comments, Begleiter gives WLKP shares a Buy rating, and a price target of $27 that implies a one-year upside of 23%. Based on the current dividend yield and the expected price appreciation, the stock has ~32% potential total return profile. (To watch Begleiter’s track record, click here)

Overall, there are 3 recent analyst reviews here, breaking down 2 to 1 favoring Buy over Sell, for a Moderate Buy consensus rating. The stock is selling for $21.90, and its $25.67 average price target suggests a potential one-year gain of 17%. (See WLKP stock forecast)

Frontline, Ltd. (FRO)

Next up is Frontline, one of the world’s major oil tanker operators. The company sails the global oceanic trade routes, with a fleet of 66 modern tankers, ranging in size from 110,000 ton Aframax vessels, to 157,000 ton Suezmax vessels, to the giants of the tanker industry, Very Large Crude Carriers (VLCCs) in the 300,000+ ton neighborhood. Frontline operates 22 vessels in that latter category; 25 of its vessels are Suezmax, the largest that can transit the Suez canal; and 19 are Aframax.

Frontline runs a modern tanker fleet. While the oldest vessels in the company’s inventory were built in 2009, most of the fleet – 56 vessels – is less than 10 years old. The most recent ships on Frontline’s register are 6 VLCCs, of which 4 were built in 2022 and 2 in 2023. Frontline has been in operation since 1985, and in recent quarters has seen a sharp increase in total revenues.

That can be seen in the last quarterly report, from 1Q23. The company reported a total operating income of $511.6 million for the first three months of 2023. This was more than double the $222.8 million reported for the prior-year quarter. Frontline’s bottom line adjusted earnings were reported at $193.3 million for the quarter, translating to 87 cents per diluted share. This was a strong turnaround from the 2-cent adjusted EPS loss reported in 1Q22, and 5 cents above expectations.

Of particular interest to dividend investors, Frontline’s net cash from operations – a vital metric in supporting a dividend – came to $262.7 million in 1Q23. This was far ahead of the $19.9 million from 1Q22. The gains in cash were supported by strong time charter equivalents, the average daily rates the company earned from tanker charters. These came to $52,500 for VLCCs, $64,000 for Suezmax ships, and $56,300 for Aframax vessels. These rates far exceeded the company’s estimated cash breakeven rates, by almost 2x for VLCCs, nearly triple for the Suezmax, and by a factor 3.35 for the Aframax ships, ensuing that Frontline can remain profitable and continue to generate cash.

Turning to the dividend, we find that Frontline declared a 70-cent payment per common share for Q1. Going forward, this payment annualizes to $2.80 and yields a sky-high 19.27%.

Frontline’s exposure to rising tanker rates forms the core of Deutsche Bank analyst Christopher Robertson’s note on the stock. Robertson says, “While tanker market conditions have eased off the winter peaks, rates remain at historically strong levels and the medium-term outlook remains positive. Crude tonne-mile demand is expected to increase this year despite OPEC cuts due to growing exports from the Atlantic Basin (US, Guyana, Brazil) and Norway. Product tanker tonne-mile demand is also set to increase as refinery capacity continues to shift east of Suez and as the market for Russian oil products remains dislocated…”

Looking ahead, Robertson puts a Buy rating on FRO shares, and his $17 price target suggests a 17% upside in the next 12 months. (To watch Robertson’s track record, click here)

Overall, this stock gets a Strong Buy consensus rating from the Street’s analysts, based on 5 Buys and 1 Hold. The stock’s average price target of $22.59 implies a gain of ~51% in the coming year from the $15 trading price. (See FRO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue