Microsoft’s (MSFT) Q3 earnings last week turned out to be a mic-drop moment for analysts, as the tech behemoth didn’t just surpass expectations, but totally crushed them. Since the announcement, seven Wall Street firms have reiterated their bullish stances on MSFT.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Azure’s explosive growth, in particular, stole the show. Paired with OpenAI, Microsoft is sprinting ahead in the AI race, leaving competitors scrambling. And then, even after the stock’s post-earnings jump, MSFT still feels like a smart buy. For these reasons, I remain as bullish as ever.

Microsoft’s Winning Streak Continues in 2025

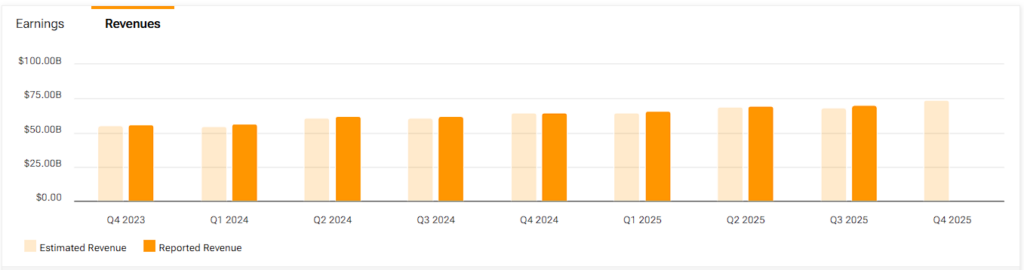

Satya Nadella gave a masterclass on running a tech empire with Microsoft’s Q1 report. Revenues landed at $70.1 billion, up 13% year-over-year, blowing past Wall Street’s $68.48 billion forecast. EPS hit $3.46, also topping the $3.22 estimate. Every segment fired on all cylinders: Intelligent Cloud, powered by Azure, soared 21% to $26.8 billion; Productivity and Business Processes, home to Microsoft 365, climbed 10% to $29.9 billion; and More Personal Computing, boosted by Xbox and search, grew 6% to $13.4 billion.

So, what’s behind the tech giant’s resilient streak? Azure’s AI workloads are a big piece, with tools like GitHub Copilot now in the hands of 15 million developers, up 50% from last year. Microsoft 365’s commercial cloud revenue jumped 15%, thanks to Copilot integrations and Dynamics 365’s 20% growth. Gaming also held strong post-Activision Blizzard, with Xbox content revenue up 8%. That’s what solid execution across the board looks like.

The Azure and OpenAI Powerhouse Pulls Ahead

But besides Microsoft’s broader wins, I want to focus on Azure and its 33% growth in Q3 (35% in constant currency), which was flat-out incredible, outpacing the 31.5% Wall Street anticipated. AI services made up 16% of that jump, as demand for AI tools and solutions remains vibrant. Clearly, Microsoft’s early partnership with OpenAI is paying dividends, with Azure powering ChatGPT and other models. A beefy new OpenAI contract in Q3 sent commercial bookings soaring 18%, locking future revenue.

In the meantime, Microsoft’s $80 billion data center push is easing capacity bottlenecks, allowing Azure to handle massive AI workloads. They’ve cut GPU setup times by 20% and boosted AI efficiency by 30%, as highlighted in the post-earnings call. To give you some perspective on how strong the quarter was for Azure, Amazon’s AWS grew by just 16.9% to $29.27 billion, over the same period, missing Wall Street’s 17.4% target, and decelerating from earlier quarters.

There is no doubt that Azure’s revenue acceleration, especially alongside a slowdown from what may be its strongest competitor, underscores Microsoft’s rising advantage in the AI race. The numbers don’t lie. Azure’s AI Foundry, supporting models from OpenAI to DeepSeek, processed 100 trillion tokens in Q3, a 5x leap from last year. Enterprises are flocking to Azure’s secure, scalable platform, and competitors like AWS and Google Cloud seem to find it more challenging to maintain the much more rapid growth they once enjoyed.

Microsoft refuses to slow down as custom AI chips and global Azure expansion extend its lead. Meanwhile, OpenAI’s models running on Microsoft’s infrastructure are building an AI fortress with a suitable moat.

MSFT’s Price Tag Remains Reassuringly Expensive

MSFT’s stock has surged post-earnings, and at 32.5x forward earnings, it’s not trading at a discount. However, for a dominant company, it’s a fair price. Microsoft’s numerous qualities and underlying growth justify the premium. Analysts anticipate double-digit revenue and EPS growth through at least half a decade out. Meanwhile, Azure’s guidance for 34-35% growth in Q4 and a $315 billion backlog implies that several analysts’ estimates are quite conservative.

Sure, risks like tariffs or low-cost AI models could stir things up, but Microsoft is mostly tariff-proof, while its scale and enterprise trust are unshakable. As CFO Amy Hood proudly confirmed, the company’s diversified portfolio is its “superpower.” That premium also reflects Microsoft’s beefy operating margin, standing at 44% in Q3, among the industry’s best.

You don’t buy a stock like MSFT for a quick buck; you buy it because it’s a tech dynasty, as it once again demonstrated with its Q1 results.

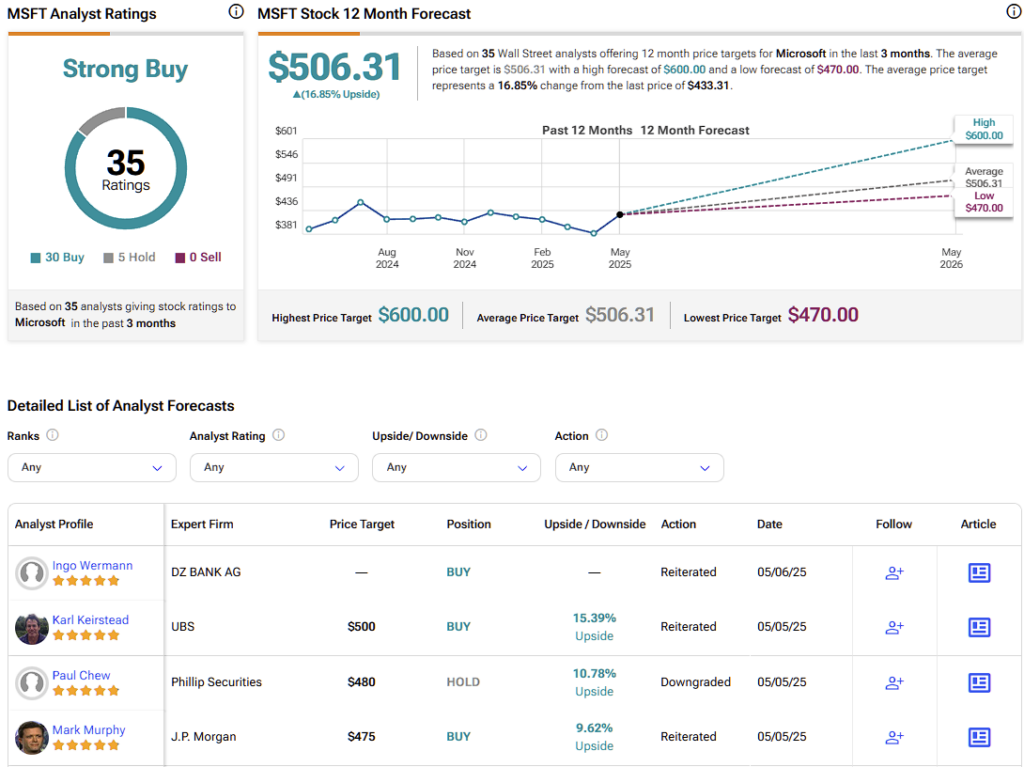

Is MSFT a Buy, Hold, or Sell?

Despite its post-earnings rally, analysts are still very bullish on MSFT stock. Over the past three months, Microsoft has gathered 30 Buy and five Hold ratings, forming a Strong Buy consensus on Wall Street. Not a single analyst has rated the stock as a Sell. Today, MSFT stock carries an average price target of $506.31, implying a ~17% upside potential from current price levels.

Exemplary AI Growth Justifies MSFT’s Market Premium

Microsoft’s latest results serve as a timely reminder of why the tech giant remains a standard-bearer for the gold standard in Technology. Azure’s AI-fueled growth, paired with OpenAI’s magic, creates distance between Microsoft and the rest of the pack. At 32.5x earnings, the stock carries a premium, no doubt. However, with double-digit growth locked in and a business firing on all cylinders, I think it’s worth every penny.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue