If you’ve closely followed the artificial intelligence (AI) boom, you may have heard of Credo Technology Group (CRDO) stock. The semiconductor company remains a hidden gem—and in my view, it’s a stock that could potentially deliver ~80% return over the next 12 months in a best-case bull scenario. I’m not alone in that outlook, either. Wall Street analysts collectively project a nearly 90% upside over the same period. However, CRDO remains a high-risk investment, and it’s best to approach it with a clear strategy and realistic expectations.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Blowout Earnings and Rapid Growth

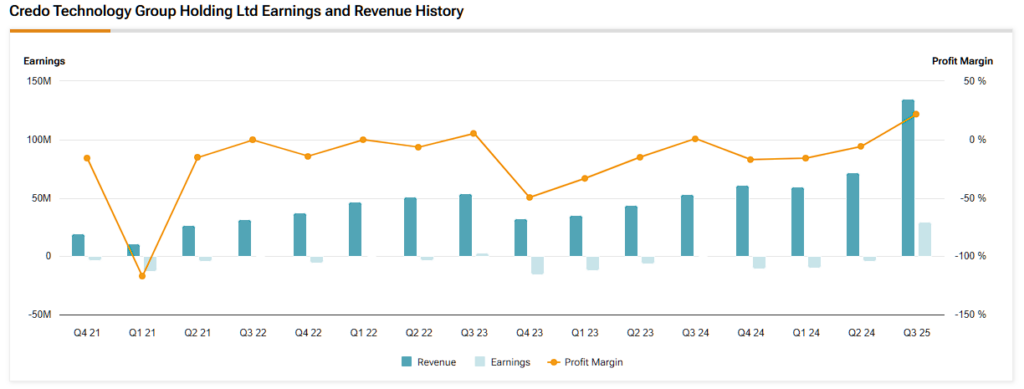

Credo’s most recent earnings report was nothing short of eye-popping. Revenue surged by 154% year-over-year and rose 87% from the previous quarter. That top-line growth carried through to the bottom line: the company reported GAAP net income of $29.4 million and GAAP earnings per share (EPS) of $0.16. Even more impressive, Credo holds $379 million in cash and short-term investments. That kind of financial position gives the company significant strategic flexibility going forward.

Notably, growth doesn’t appear to be slowing. For the upcoming quarter, management has guided revenue to $155–165 million. This implies another ~15% sequential increase at the midpoint, suggesting that the next quarter will be another record-breaker. Based on that outlook, Credo is on track to roughly double its revenue for FY2025 compared to the prior year.

So, what’s fueling this rapid growth? In a word: AI. The ongoing build-out of AI infrastructure has led to immense demand for Credo’s products, particularly its Active Electrical Cables (AECs). As companies assemble massive clusters of AI servers—imagine hundreds of GPUs running in parallel—they require tremendous bandwidth to move data efficiently. Credo’s AECs are designed precisely for that purpose.

Customer Concentration: A High-Risk, High-Reward Setup

In the third quarter, Credo’s management acknowledged that a single large cloud or data center operator “contributed over 95% of the increase” in product revenue. In other words, one of the tech giants significantly ramped up their purchases of Credo’s products. This type of customer concentration is a double-edged sword. On one hand, it’s a validation of Credo’s technology. Conversely, it makes the company’s short-term financial performance highly sensitive to a single customer’s buying behavior.

Management is well aware of the risk and is actively working to diversify the customer base. In my view, that effort will likely bear fruit. Once a significant hyperscaler signs on, it becomes much easier to onboard additional clients, especially in an industry where technical qualification and reliability are critical. In this sense, Credo’s success with one client could serve as a springboard to broader adoption across the AI infrastructure landscape.

From a macro perspective, the trend is clearly in Credo’s favor. Companies across the globe are investing heavily in data centers to support AI and cloud computing. In 2024 alone, global data center capital expenditures rose more than 50% to approximately $455 billion. I project that AI-related infrastructure capex will approach $1 trillion annually by 2030.

Credo Reaches for $90 Per Share

Credo’s all-time high share price was just over $80, but the stock has since fallen to around $45. This pullback is mainly technical, with some investors reacting to uncertainty around tariffs and potential trade tensions under a new U.S. administration. Once those concerns settle and the market regains its footing, I believe sentiment toward high-growth tech names like Credo will steadily improve.

Importantly, the fundamental investment case for Credo remains intact. While growth is slowing somewhat, that’s expected during any industry ramp-up. FY2025 revenue is expected to grow 120% year-over-year, which understandably created a lot of market excitement last year. Now, with FY2026 revenue growth projected at 60%, investor expectations are becoming more realistic. As a result, Credo’s price-to-sales (P/S) ratio has compressed from about 50 to 20.

This kind of multiple contraction is not a red flag—it’s a buying opportunity. If the company reaches $700 million in total revenue for FY2026 (a target I view as both achievable and conservative) and its share count grows to 190 million, then revenue per share would reach $3.68. At that point, a P/S ratio of 25, spurred by improving profitability, would bring the share price to my target of $90.

Is Credo Stock a Good Buy?

Wall Street is unanimous on CRDO. The stock carries a consensus Strong Buy rating, with 10 analysts rating it a Buy and none rating it a Hold or Sell. The average CRDO price target is $81 per share, implying an 88% upside over the next 12 months.

Buying Into Semiconductors from the Ground Floor

Despite the need for careful portfolio sizing, I view Credo as one of the best AI-related stocks available right now. Its unique position within the growing AI infrastructure space gives it significant near-term upside potential. If either Wall Street’s $81 or my $90 price target materializes, my portfolio will be sitting comfortably in the green—while others may find themselves scrambling to sell or, worse yet, missing the rally altogether. Credo may not be a household name yet, but I’m glad to have it in my portfolio while it’s still flying under the radar.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue