The stock of Applied Therapeutics (APLT) plunged 75% in a single trading session on November 29 after the U.S. Food and Drug Administration (FDA) ruled against the biotechnology company’s drug to treat a rare genetic disease.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

APLT stock fell more than 75% to finish trading at $2.03, wiping out nearly $750 million in valuation. The selloff was even more dramatic given that U.S. markets were only open for a few hours during a shortened trading session due to the Thanksgiving holiday weekend in America.

The plunge in the share price was swift and occurred after Applied Therapeutics said it received a letter from the FDA in which the agency declined to approve a drug to treat the metabolic disorder “Classic Galactosemia.”

Dramatic Turnaround

In a statement, Applied Therapeutics said that the FDA had cited “deficiencies in the clinical application” of the genetic drug as the main reason it declined to approve it for commercial sale in the U.S. The company had planned to market and sell the drug under the name “Govorestat.”

Applied Therapeutics CEO Shoshana Shendelman said she was “disappointed by the FDA’s decision,” and added that the company would “work with the FDA to address the concerns” raised by the agency that regulates food and prescription medications in America.

The 75% dive in APLT stock is a big reversal. Prior to the big one-day plunge, Applied Therapeutics share price had been up 135% this year on optimism that the genetic drug would be approved. At $2.03 a share, APLT trades as a penny stock, defined as any security whose price is below $5.

Is APLT Stock a Buy?

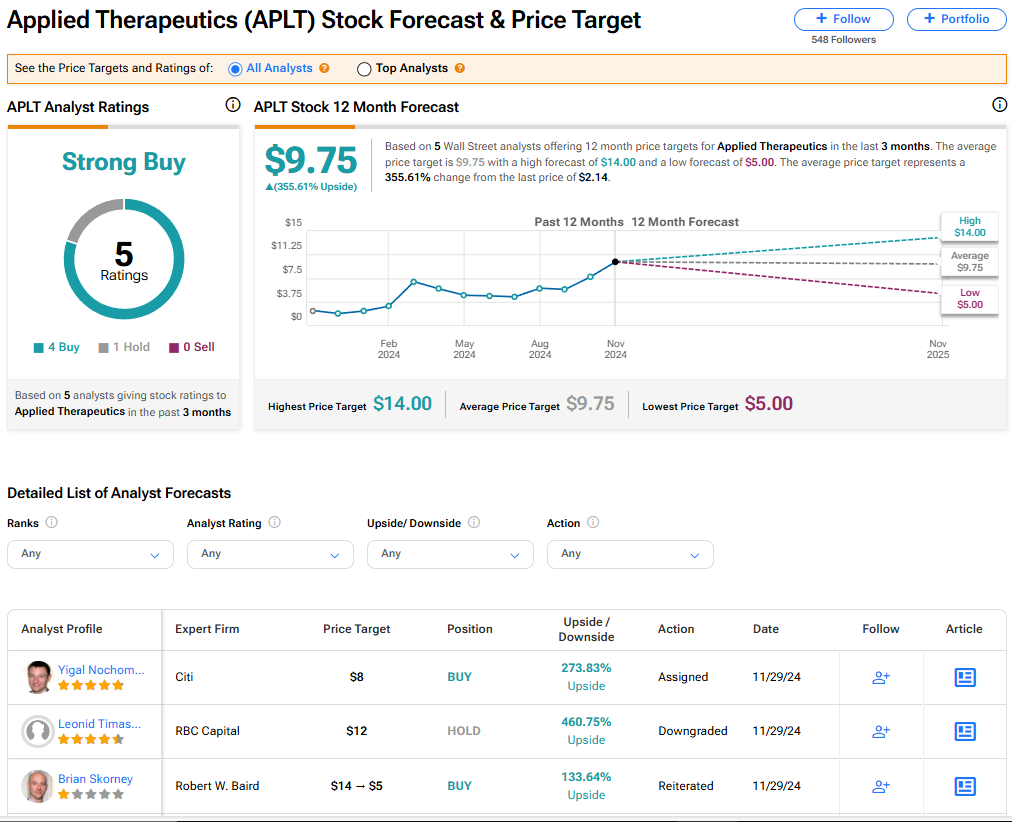

The stock of Applied Therapeutics has a consensus Strong Buy rating among five Wall Street analysts. That rating is based on four Buy and one Hold recommendations made in the last three months. The average APLT price target of $9.75 implies 355.61% upside from current levels. It should be noted that analyst ratings are likely to now change after the FDA declined to approve the company’s leading drug candidate.

Read more analyst ratings on APLT stock

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue