Apple shares (AAPL) were lower today as steep discounts helped the tech giant to higher sales in China.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Apple stock was down 0.3% in pre-market trading despite data showing that sales of foreign-branded mobile phones in China, including its Phones edged up in April.

Foreign Sales Fly

The data from the China Academy of Information and Communications Technology (CAICT) showed that April shipments of foreign-branded phones in China rose to 3.52 million units from 3.50 million a year earlier.

As the largest foreign mobile phone maker in China’s smartphone-dominated market, Apple will have contributed hugely to the performance.

The uptick in April comes after a poor first quarter in which Apple’s phone sales in China dropped 9%.

Apple has faced increased competition from domestic rivals such as Huawei. That was boosted by Chinese government subsidy programs in January for smartphones under $820.

It is also being held back by the absence of a foldable smartphone offering, underwhelming AI capabilities and Chinese consumers mow more focussed on performance rather than brand.

Long-Term Strategy

As such it has resorted to price cuts to stay competitive. Chinese e-commerce platforms are offering discounts of up to 2,530 yuan (351) on Apple’s latest iPhone 16 models earlier this month.

However, this is only a short-term solution. Apples still needs to focus on its long-term strategy to regain its status in China.

That is likely to be complicated by President Trump’s tariffs which is set to shift a significant proportion of Apple’s iPhone production from China to India and the U.S. This may impact sales in China but conversely boost those in the emerging market of India.

Is AAPL a Good Stock to Buy Now?

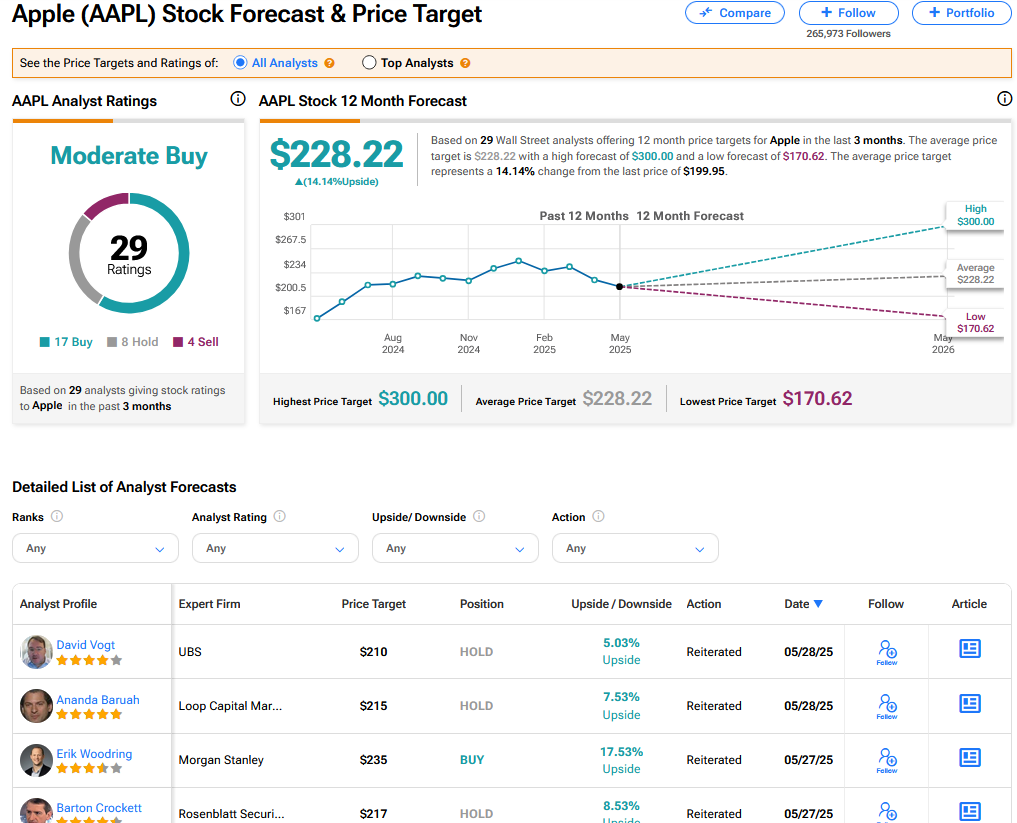

On TipRanks, AAPL has a Moderate Buy consensus based on 17 Buy, 8 Hold and 4 Sell ratings. Its highest price target is $300. AAPL stock’s consensus price target is $228.22 implying an 14.14% upside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue