Despite the favorable trade deal between the U.S. and China, Apple (AAPL) stock is down about 17% year-to-date. Concerns about tariff uncertainties, the impact of macro pressures on consumer spending, heightened competition in the smartphone market, and the lower-than-expected Services revenue in the March quarter have impacted investor and analyst sentiment. Consequently, several analysts are cautious on AAPL stock and see limited upside potential from current levels.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Analysts Highlight Near-Term Pressures on Apple Stock

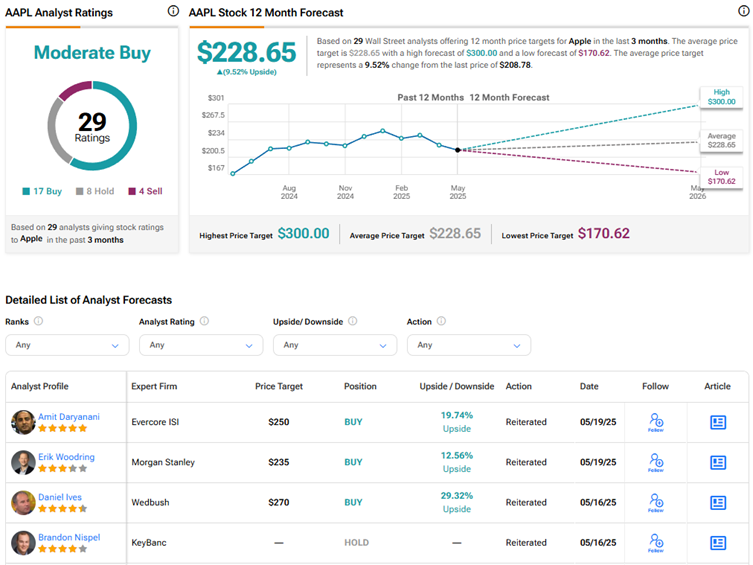

In a research note on Monday, Morgan Stanley analyst Eric Woodring reiterated a Buy rating on Apple stock with a price target of $235. Following an analysis of Q1 2025 13-F filings, Woodring noted that Apple remains the most under-owned mega-cap tech stock among large institutions, while Meta Platforms (META) remains the most over-owned stock. He noted that Apple’s active institutional portfolio weightage fell to 4.86%, while its S&P 500 (SPX) weightage dropped more steeply to 6.9%.

Nonetheless, Woodring remains upbeat about Apple stock due to his long-term bullish thesis. While the analyst is confident about meaningful upgrades and replacement cycles for iPhone, he cautioned investors that litigation risks, tariff uncertainties, and the lack of guidance for Services revenue for the June quarter could limit near-term upside.

Yesterday, Evercore analyst Amit Daryanani reiterated a Buy rating on AAPL stock with a price target of $250. The 5-star analyst contends that the legal and technological challenges faced by Apple’s Services business are getting huge attention, given that this business has driven the company’s growth and margin expansion in recent years. He believes that Apple is refraining from providing Services disclosures, which is an incremental concern for investors.

Daryanani noted that the two major risks for Apple’s Service business are its legal dispute with Epic Games and the default search engine payment from Alphabet’s Google (GOOGL). He thinks that investors have become notably negative on AAPL stock. Consequently, if any of the court cases or tariff issues go AAPL’s way (or are less adverse than anticipated), that could be a sizable positive for the stock.

Meanwhile, Phillip Securities analyst Helena Wang lowered the price target for Apple stock to $200 from $235 and reiterated a Hold rating. The analyst lowered her estimates following the March quarter results to reflect lower gross margin due to tariffs. Wang is cautious on Apple stock due to tariffs woes, elevated capex, and continued weakness in products and the crucial China market.

Is AAPL a Buy, Sell, or Hold?

Overall, Wall Street is cautiously optimistic on Apple stock, with a Moderate Buy consensus rating based on 17 Buys, eight Holds, and four Sell recommendations. The average AAPL stock price target of $228.65 implies 9.5% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue