Advanced Micro Devices (AMD) is laying off nearly 4% of its global workforce, or around 1,000 employees. The company plans to focus on developing artificial intelligence (AI) chips to better compete with industry giants such as Nvidia (NVDA).

AMD’s decision is backed by the rapid growth of its Data Center segment, which witnessed a 122% surge in revenue in the third quarter. The impressive growth was fueled by robust demand for the company’s chips to support generative AI applications like ChatGPT. Interestingly, AMD raised the segment’s 2024 sales expectations to $5 billion from the previous forecast of $4.5 billion.

To benefit from this growing demand, AMD is heavily investing in its research and development. The company also plans to begin mass production of its new MI325X AI chip in the fourth quarter. However, scaling up the production of these advanced chips has been challenging due to AMD’s limited manufacturing capacity. As a result, AMD is cutting jobs to redirect resources toward AI development.

Layoffs Sweep Tech Sector

AMD’s layoffs reflect broader industry trends, as tech giants like Chegg (CHGG), Microsoft (MSFT), and Intel (INTC) have also announced job cuts in recent months. These decisions were primarily driven by economic uncertainty, intense competition, and the need to invest in AI development.

Recently, Chegg disclosed layoff plans for 21% of its employees due to growing competition from ChatGPT and other AI products. Similarly, in October, Intel revealed plans to cut 2,000 positions in the U.S. Further, Microsoft laid off another 650 employees from its gaming division, following 1,900 job cuts in January.

Is AMD a Good Stock to Buy?

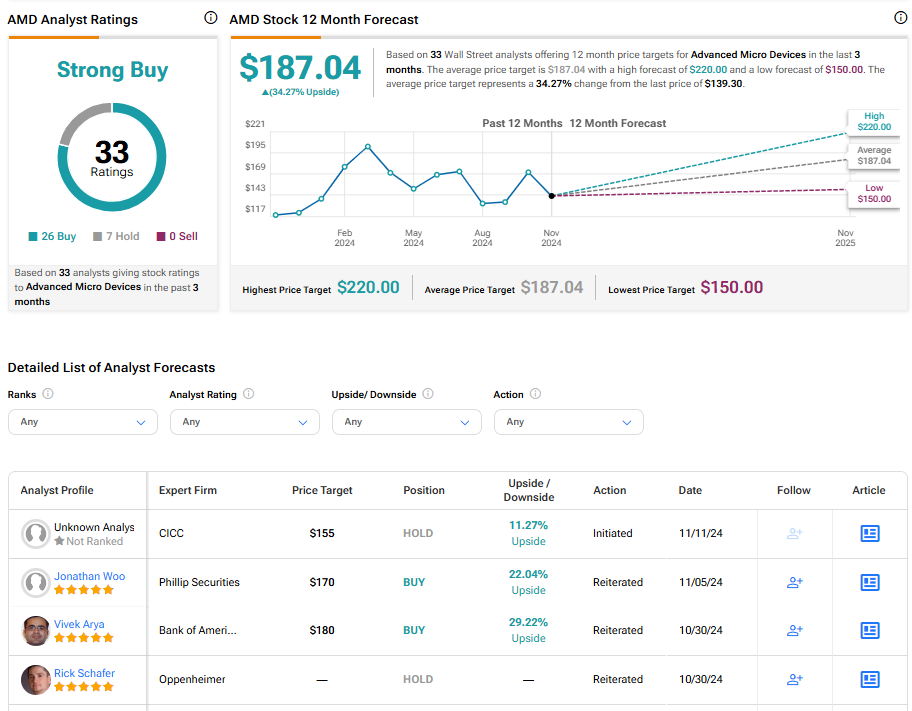

Turning to Wall Street, AMD has a Strong Buy consensus rating based on 26 Buys and seven Holds assigned in the last three months. At $187.04, the average Advanced Micro Devices price target implies a 34.27% upside potential. Shares of the company have declined 5.5% year-to-date.