Alibaba (BABA) is ramping up its cloud and AI ambitions. The company recently revealed a $53 billion investment plan over the next three years to enhance its AI and cloud capabilities. On Monday, Barclays analyst Jiong Shao gave Alibaba stock a thumbs-up with an Overweight rating and a price target of $180, citing the strong growth potential in the company’s cloud division. The price target implies an impressive 60.3% upside potential from current levels.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

It is worth noting that Shao ranks 1,214 out of more than 9,418 analysts tracked by TipRanks. He has a success rate of 49%, with an average return per rating of 7.2% over a one-year timeframe

BABA’s Cloud Business Gathers Steam

Alibaba’s cloud business is gaining strong momentum, and it’s not just a short-term boost. According to the four-star analyst, growth in this segment picked up in the March quarter and is expected to stay strong through the rest of the year, driven by growth in AI.

As China’s largest AI infrastructure provider, Alibaba is quickly emerging as a central player in the country’s booming AI sector. Shao notes that the company’s cloud arm already generates around $20 billion in revenue and $2 billion in EBITDA annually, and that number is likely to grow with the increasing adoption of AI. With China shifting from AI model training to real-world use cases like inferencing and edge computing, Alibaba seems well-positioned to benefit, according to the analyst.

It’s important to highlight that in the third quarter of fiscal 2025, Alibaba’s cloud revenue rose 13% year-over-year to ¥31.7 billion ($4.3 billion). More notably, AI-related product revenue saw triple-digit growth for the sixth straight quarter, showing strong demand for its services.

Despite these solid results, Shao believes Alibaba’s cloud business is still underappreciated by the market. As AI adoption continues to rise, and Alibaba remains at the forefront of that growth, investors may start to see more upside in the stock.

What’s Next for Alibaba Stock?

Alibaba is expected to report its Fiscal Q4 2025 earnings on May 14, 2025. Wall Street expects the company to report revenues of $32.76 billion, reflecting a 6% year-over-year increase. Meanwhile, earnings per share are expected to come in at $1.72, up 24% year-over-year.

Even so, all eyes will be on Alibaba Cloud. With its AI push gaining traction and revenue picking up speed, it will be interesting to see just how much momentum the cloud business adds to the upcoming results.

Is Alibaba Stock a Good Buy Now?

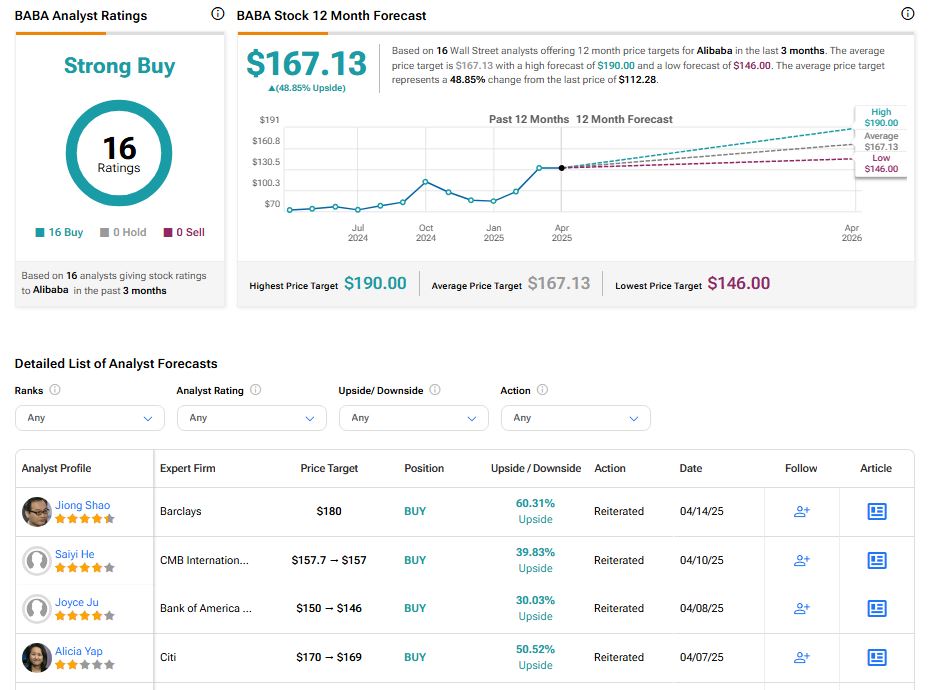

On TipRanks, BABA stock has a Strong Buy consensus rating based on 16 unanimous Buys assigned in the last three months. At $167.13, Alibaba stock price target implies a growth rate of 48.85% on the current trading price.