Shares of AppLovin (APP) are down 15% on news that another short seller is targeting the mobile technology company.

In this latest case, short seller Fuzzy Panda has issued a report that questions the integrity of the company’s artificial intelligence (AI)-powered AXON advertising software that has helped drive the company’s share price higher over the last year.

The latest critical report comes a week after short seller Edwin Dorsey accused AppLovin of committing “advertising fraud” in his Bear Cave substack newsletter. The report from Fuzzy Panda also claims that AppLovin is employing fraudulent advertising tactics and that the company and its share price have been built on a “House of Cards.”

‘Every Trick in the Book’

“We believe AppLovin has pulled every trick in the book. We’ve been told they are stealing data from Meta (META) in their e-commerce push. We also discovered AppLovin exploiting consumers and their data in ways which are clear violations of Google (GOOGL) and Apple’s (AAPL) app store policies,” states Fuzzy Panda in its report.

The short seller report from Fuzzy Panda comes after AppLovin issued strong fourth-quarter 2024 financial reports in early February, and as Wall Street analysts remain bullish on APP stock. AppLovin reported that its advertising revenue rose 73% in Q4 2024 to nearly $1 billion. The company has also announced plans to spin-off its mobile gaming segment.

APP stock skyrocketed more than 700% in 2024, making it a top-performing technology concern. But more recently, AppLovin’s stock has declined 31% over the last five trading sessions as the short seller reports shake investor confidence in the security.

Is APP Stock a Buy?

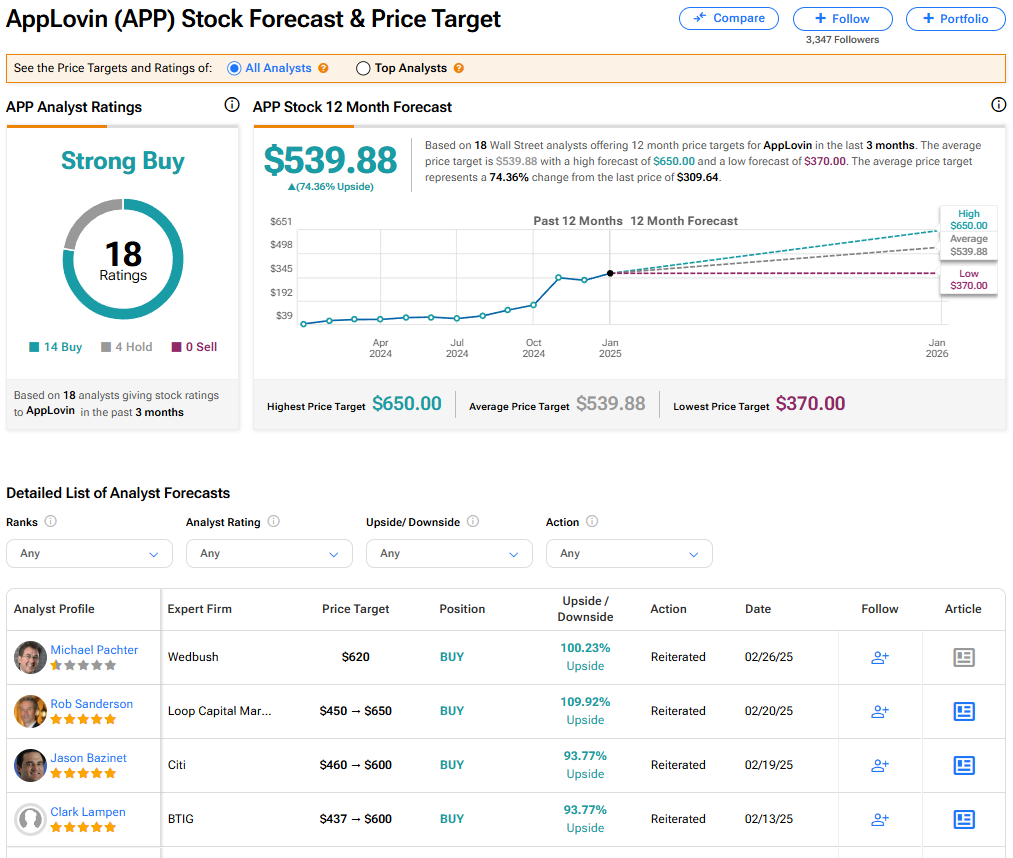

AppLovin stock has a consensus Strong Buy rating among 18 Wall Street analysts. That rating is based on 14 Buy and four Hold recommendations issued in the last three months. The average APP price target of $539.88 implies 74.36% upside from current levels.